On March 18, in the wake of the COVID-19 pandemic, the Malaysian government implemented an ongoing Movement Control Order (MCO). Following that, the Malaysian Communications and Multimedia Commission (MCMC) announced that Celcom, Digi, Maxis and U Mobile would be offering to all their customers (prepaid and postpaid) 1GB of free data each day between 8 am to 6 pm, beginning April 1, 2020, until restrictions were relaxed, while Unifi also offered various unlimited plans to extend support to its customers. As more and more Malaysians remained indoors in adherence to the order, their dependence on mobile networks for work, education, information, and entertainment increased during the crisis. MCMC reported a significant surge in data traffic and suspected that greater data consumption had affected the users' network experience in different ways.

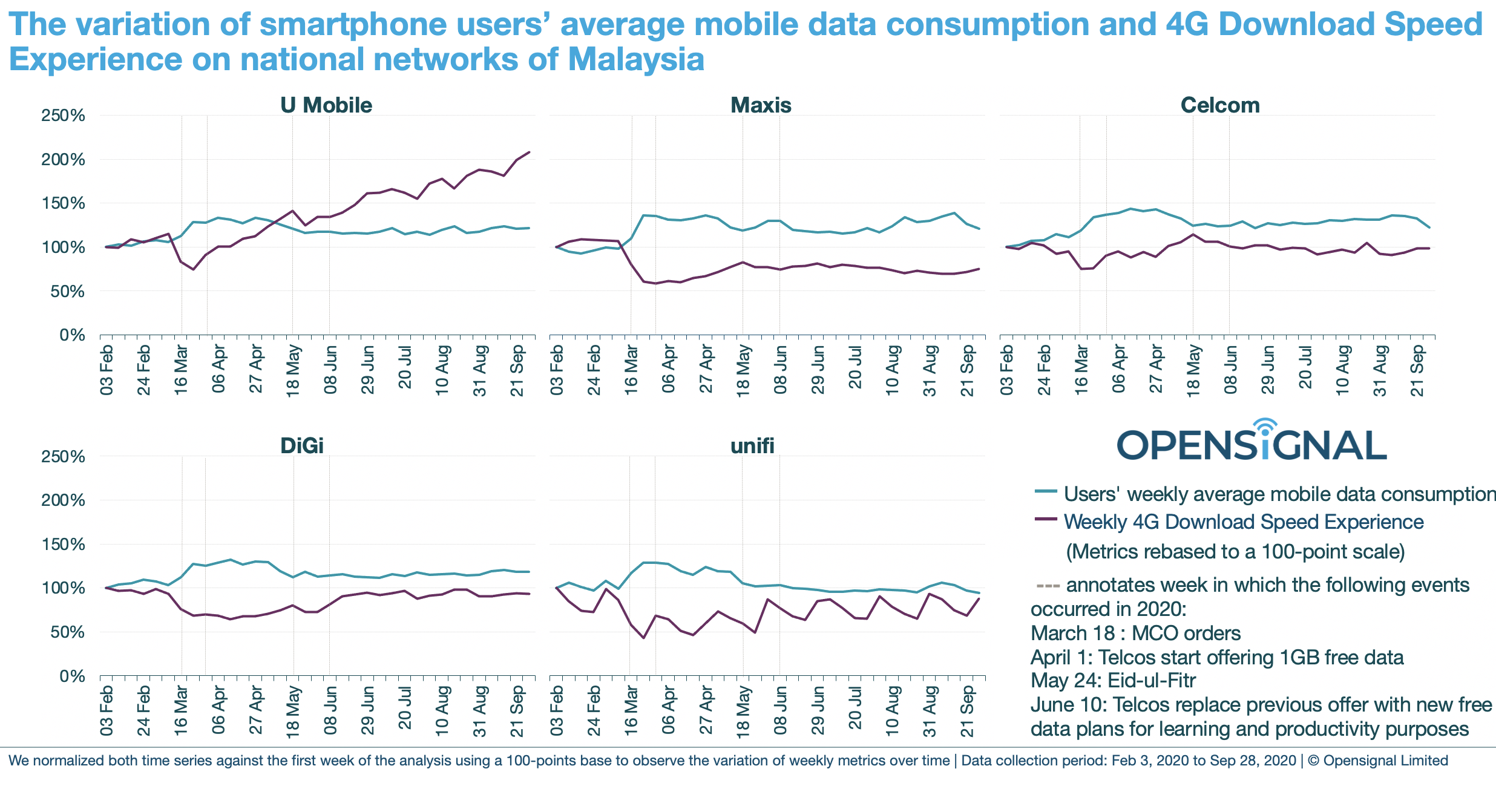

Opensignal quantified our Malaysian smartphone users' average mobile data consumption and compared it against their average 4G Download Speed Experience on the country's five national mobile networks since the early months of the year. We observed that our Malaysian smartphone users' average mobile data consumption increased drastically over a few weeks across all networks — concurrently with the MCO's introduction — and this was associated with significant drops in our users' average 4G Download Speed Experience. While our users' data consumption on most networks in the third quarter of 2020 has remained above pre-MCO levels, their average download speeds are slowly returning to normal and even improving beyond those seen before the MCO in some cases. It was noteworthy that our U Mobile users saw a significant improvement in their 4G Download Speeds, during this period, with speeds more than twice as fast as pre-MCO levels.

Opensignal measured our smartphone users' weekly average mobile data consumption and average 4G download speed from the week starting on February 3 to the week ending on October 4. Then, we normalized the two time series against the first week of the analysis using a 100-points base to observe how speed and data consumption changed over time.

On average, our smartphone users consumed a similar amount of mobile data throughout the initial weeks of the year, and their mobile speeds did not change significantly. However, as the Malaysian government implemented MCO, starting March 18, we observed a sharp increase in average data consumption on all five networks compared to the start of the year, which stayed significantly higher all the way through the last week of our analysis, ending September, on four out of five networks. The data consumption was at its peak on most Malaysian networks until the week commencing on May 18. Celcom's network saw the highest increase in average data consumption — up to 44% — followed by a surge of up to 36% on Maxis, while that on its peers’ networks ranged below 35%.

In the following weeks, average data consumption was relatively lower for all operators' networks but was still significantly above pre-MCO levels, with a few upsurges in two weeks of June on Maxis’ network, when operators announced the new daily plan, which replaced the free daily 1GB high-speed mobile data package offered earlier. Unifi was the only exception — the operator saw the average data consumption on its network retreat back to normal levels in the week starting June 15.

Concurrently, the 4G download speeds experienced by our users declined sharply: from the third week of March (starting March 16), our unifi users saw their average 4G download speed experience deteriorate by up to 57%, followed by their Digi and Maxis counterparts with speeds averaging up to 36% and 41% lower respectively, while their peers on U Mobile and Celcom saw up to 25% slower speeds.

The timeline and the magnitude of the effect on download speeds varied depending on our users' choice of network. While our Maxis and unifi users saw lower speeds until the last week of September, our Celcom and DiGi users saw download speeds returning towards normal from the first week of May and third week of June respectively.

That said, it was noteworthy that our U Mobile users saw lower download speeds only until the last week of March; their 4G download speeds not only returned to normal but continued to improve steadily over the next few weeks. By the end of September, our U Mobile users experienced 4G download speeds more than twice as fast compared to the beginning of the year. Our data suggests that U Mobile has been improving its network infrastructure by adding capacity and optimizing its existing cells over the last couple of months to support the large increase in demand for data.

Additionally, we found a peculiar trend in the average 4G download speeds reported by our Unifi users. The trendline showed a series of peaks, at the beginning of each month, and troughs appearing in the middle of the month, and continuing to the end. This swinging trend suggests that our Unifi users generally experience speed caps once they run out of the mobile data included in their packages.

As data consumption surged during the early months of the pandemic, more users experienced lower average 4G download speeds.

We further analyzed the distribution of our users' 4G download speeds for February, April and July to understand the variations in download speeds before, during and after the period in which the unlimited plans were offered. We found that a higher proportion of users, on average, experienced lower download speeds in April, compared to February. The percentage of users who experienced speeds up to 10 Mbps increased by 11.5 percentage points, while the percentage of users who experienced speeds between 10-20 Mbps, 20-30 Mbps, 30-40 Mbps all decreased between 2-3.4 percentage points. In June, the proportion of users experiencing slower speeds was relatively lower than that in April.

Our analysis demonstrates the impact of introducing free data services and relaxed data limits following the implementation of the MCO on both the data traffic volumes carried by the mobile operator networks and our users’ mobile experience. While the relaxation of data limits was likely a major factor determining the changes we observed, many other factors may have contributed as well.

Malaysian operators may have taken pre-emptive measures or managed data traffic differently to reduce the risk of outages. Some operators also confined the access of free internet offers to productivity and information related apps/services/websites. Furthermore, with students and employees working from home, and shifts in user behavior during the lockdown, average speeds could have diminished during the non-peak hours, bringing down overall speeds.

Additionally, many Malaysians working in cities moved out to their kampungs in the suburbs or rural areas to avoid being quarantined in the city. This change in mobile usage location means users were spending more time in locations where the network infrastructure may not have been designed to support such a large number of users and their increased mobile data usage.

Despite these challenges, Malaysia’s operators have provided resilient services to their mobile users in this unprecedented situation, as seen in our latest report. That said, the Malaysian government has launched several initiatives, to improve network coverage and ensure the high quality of the country's telecommunications, while Malaysian operators continue to invest in increasing capacity and upgrading their networks, under the ongoing National Fiberisation and Connectivity Plan (NFCP).

Our data shows that mobile data consumption in Malaysia has increased significantly during the COVID-19 pandemic. While it has declined from the peak observed back in late March to mid-May, it is likely to keep growing in the future. Our data also shows that Malaysian users’ download speeds bounced back after a temporary drop and, as mobile operators, MCMC and the government keep working together, users are likely to see their mobile experience improve in the coming months.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].