While eSIM adoption in the mobile market has been arriving for some time, Apple’s move to make eSIM the only option for iPhone 14 range in the U.S. is propelling the worldwide shift towards eSIM technology. Opensignal's latest analysis reveals a significant surge in the proportion of users switching their operator among those who use an eSIM across seven examined markets – Brazil, Indonesia, Singapore, South Korea, Taiwan, the U.K. and the U.S.

The switch from physical to embedded SIM cards threatens to alter how consumers switch operators and encourages operators to adopt new tactics to retain and acquire users, for example operators can offer network trials from within an app that provisions an eSIM immediately. eSIM also means the risks to operators of dual SIM devices that have long been common in many international markets are arriving in operator-controlled markets too, such as the U.S. and South Korea. Even on smartphones sold by operators, eSIM support is usually present in addition to a physical SIM, making them dual-SIM devices.

Google added eSIM-support to the Pixel range in 2017, Samsung added eSIM support to 2019’s Galaxy S20 flagship. While Apple first added eSIM to their phones in 2018 with the iPhone Xs, it switched to selling exclusively eSIM models in the U.S. with the iPhone 14 range in late 2022. South Korea is also a special case – eSIM support for domestic customers only began in mid-2022, before this point it was only available to international travelers. Notably, Samsung responded by introducing eSIM to a selection of its flagship devices in the home market, which had not been previously available there.

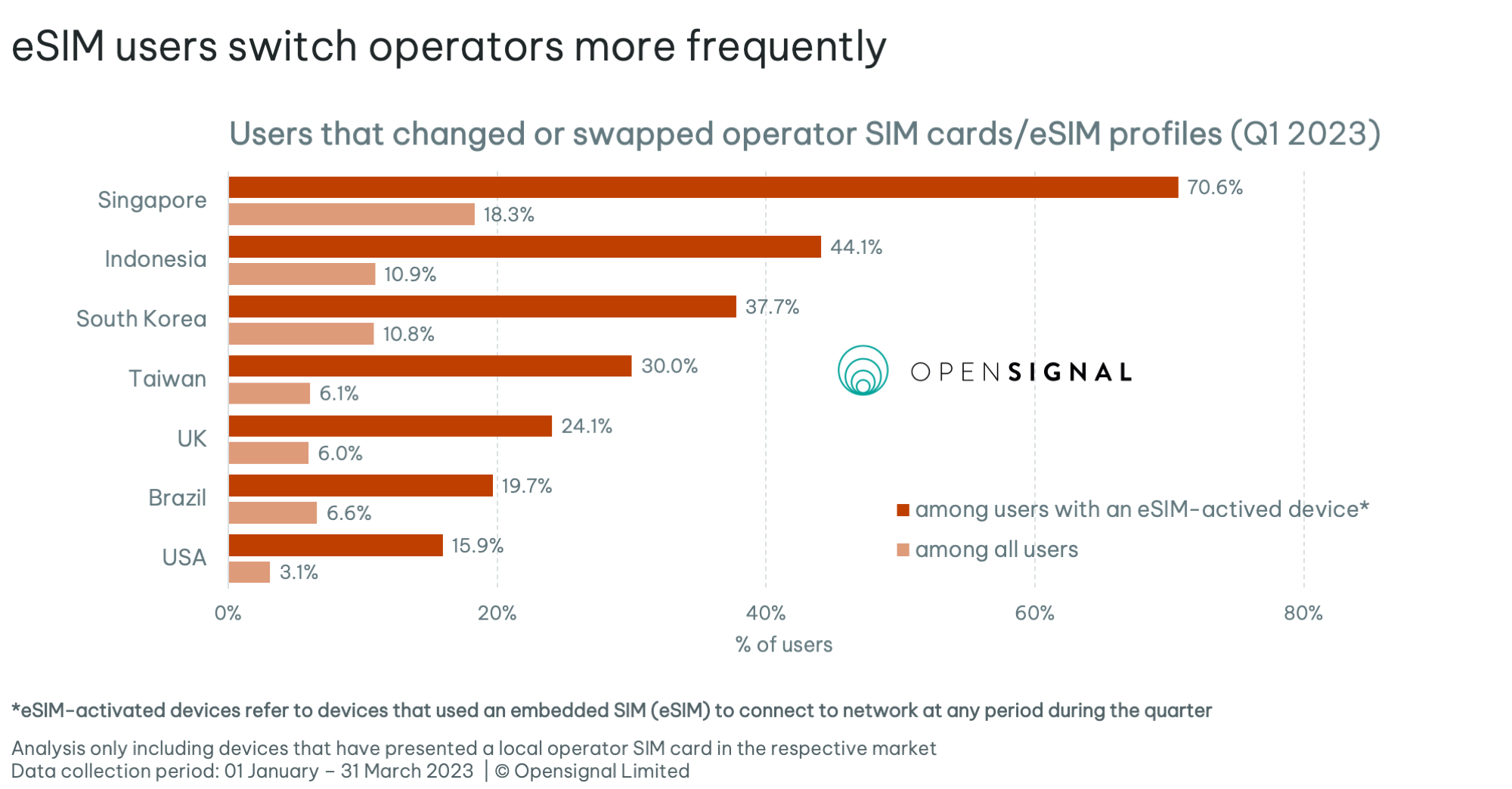

Opensignal data shows a significantly greater share of users switching operator SIM cards when they are using a device that had an active eSIM. For instance, among all our users in the U.S. and Singapore we observe that respectively 3.1% and 18.3% of them had switched between different operators at any point during the first quarter of 2023. The percentage rises dramatically to 15.9% and 70.6% among users who had been actively using eSIM on their device. These switchers include both permanent operator transitions, as well as users swapping back and forth between different operator SIM cards – which was occurring much more frequently among eSIM-activated devices.

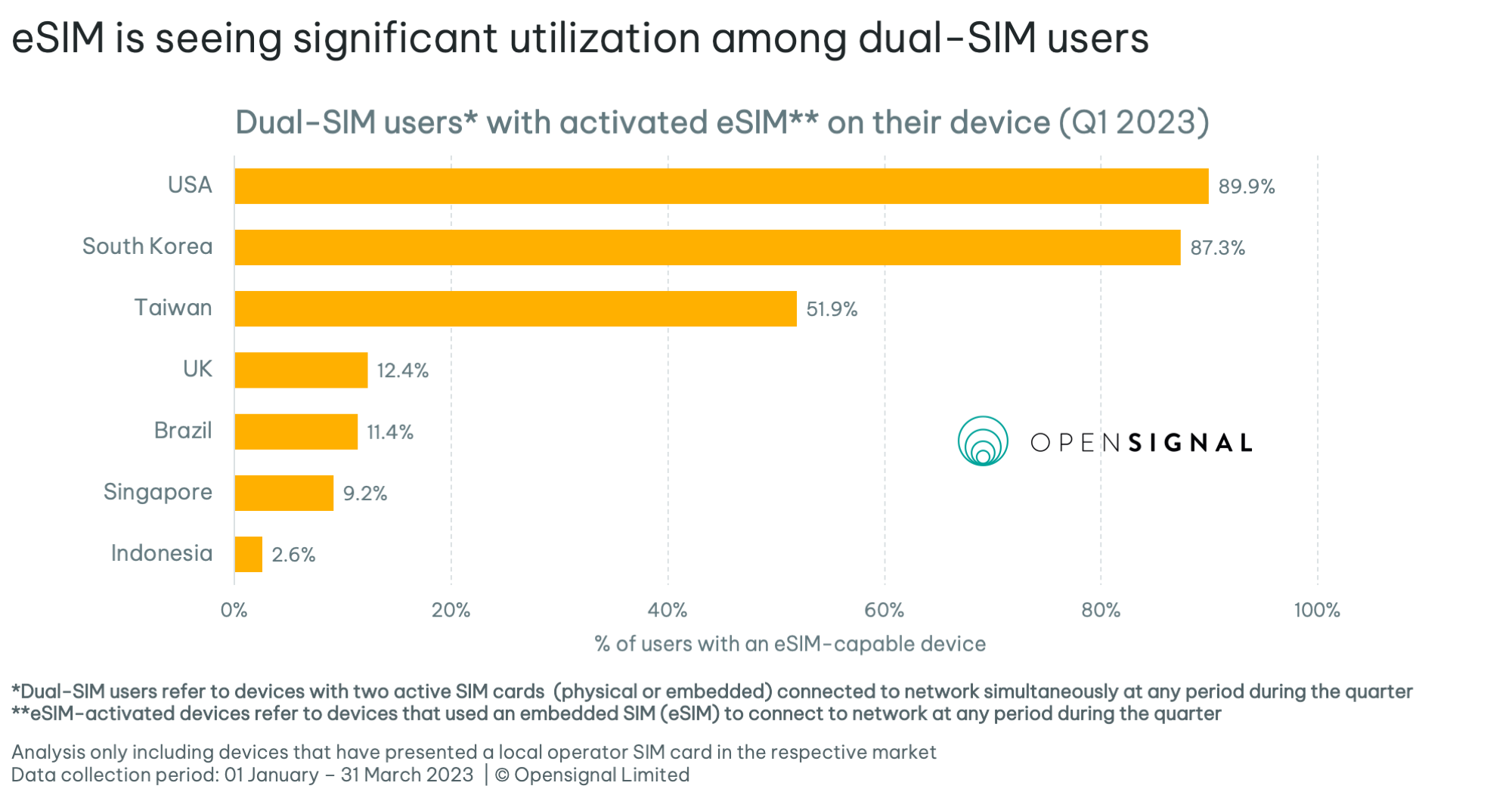

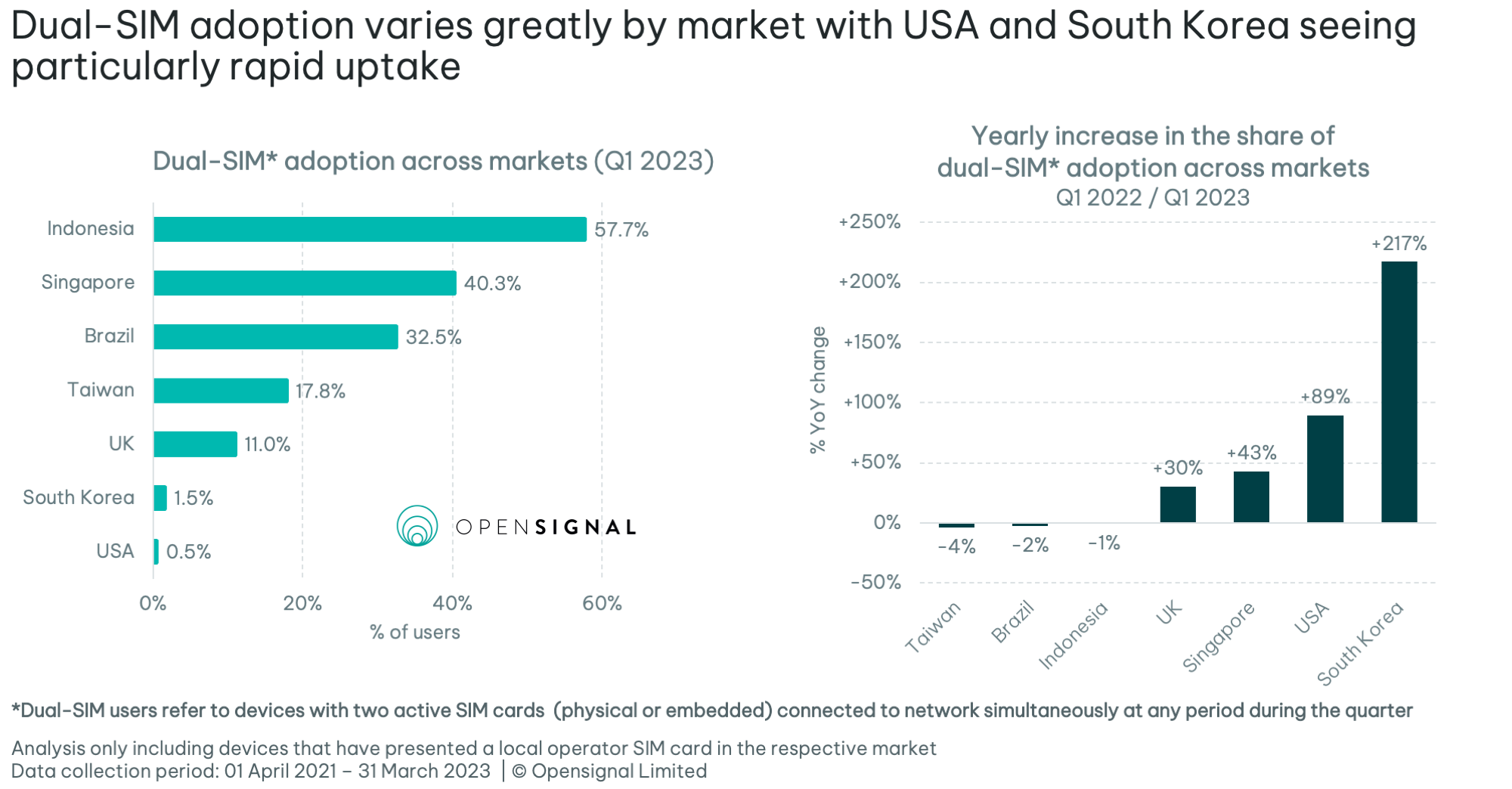

The data also shows that eSIM technology is finding particular appeal among dual-SIM users, and is further driving the adoption of dual-SIM usage in a number of markets where the usage was previously limited or non-existent. The latter trend is particularly visible in the U.S. and South Korea – compared to a year ago dual-SIM penetration nearly doubled in the U.S. (+89%) and more than tripled in South Korea (+217%). The eSIM + physical SIM combination has opened up the door to dual-SIM usage in these two markets – among our dual-SIM users with an eSIM-capable phone, respectively 87.3% and 89.9% had an active eSIM alongside their physical SIM in Q1 2023. Taiwan’s share stood at 51.9%, but the market has an established and widespread penetration of dual-SIM usage (17.8% of all users had dual-SIM there in the same period). Indonesia, meanwhile, while having high penetration of dual-SIM usage (57.7%), is still at a very early stage of eSIM adoption, with only 2.6% of dual-SIM users with an eSIM installed, among eSIM-capable device base in Q1 2023.

The proportion of dual-SIM users varies significantly across the seven analyzed markets. Indonesia stands out with the highest proportion – 57.7% of users were recorded using two active SIMs in their device in Q1 2023. Dual-SIM usage in Indonesia exhibits an established pattern with penetration having remained virtually unchanged from Q1 2022, similar also to Taiwan and Brazil. On the other hand there are the U.S. and South Korea, where dual-SIM usage is undergoing rapid growth – compared to a year ago, dual-SIM penetration nearly doubled in the U.S. (+89%) and more than tripled in South Korea (+217%), but still accounts for only 0.5% and 1.5% of our users' devices respectively in Q1 2023. Singapore stands out with high penetration and high growth of dual-SIM usage – in this market 40.3% of our users were with dual-SIM in Q1 2023, while this penetration has also grown by 43% compared to a year ago.

eSIM is already changing how consumers switch operators

Opensignal’s new analysis shows that the arrival of eSIMs is altering how consumers switch operators. eSIM will cause operators to adopt new tactics to retain and acquire users. eSIMs threaten to make it easier for consumers to switch operators, as it means they can do so without face-to-face interaction or waiting for the shipment of physical SIM cards. In addition, it is possible to store several purchased eSIM profiles so users can switch frequently between operators, using optimal tariff for each specific situation like making a call or engaging in international roaming.

Opensignal will provide deeper analysis of the impact of eSIM in future insights, including looking at trends while focusing on specific regions.

Methodology notes and definitions

Dual-SIM user refers to a user’s device that has capability to use two SIM cards, and the user actively connected two SIM cards (physical or embedded) to the network simultaneously during the stated time period.

- eSIM-activated device refers to a smartphone device that used an embedded SIM (eSIM) to connect to an operator network at any point during the stated time period.

- This analysis is limited to domestic users – defined as users that used a domestic operator's SIM card (MNO or MVNO) at any period during the cited quarter. Devices that have entered the market and stayed on international roaming are excluded from the analysis.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].