South Korea’s leadership position in 5G experience is at risk as other markets deploy mmWave 5G ahead of South Korea. While South Koreans enjoy the fastest overall 5G download and upload speeds in the world, and spend the second highest time with a 5G connection — called 5G Availability — other markets are enjoying a further greater experience boost from mmWave 5G. Previously, Opensignal analysis has highlighted the importance of spectrum capacity in improving users’ mobile experience globally and in Asia Pacific. Now, we examine the impact of mmWave 5G on the global 5G landscape.

Using this extremely high capacity spectrum, users in Australia, Japan and the U.S. see much higher average speeds with mmWave than with overall 5G, and a better video streaming and multiplayer gaming experience too. Yet in South Korea, operators have had to return their mmWave spectrum licenses and so Koreans are not yet able to enjoy the same boost from mmWave. The spectrum is set to be re-auctioned in Korea with new operators incentivized.

With mmWave 5G, South Korean operators have a greater capability to counter Koreans’ disenchantment with current 5G. Recently, SK telecom discussed the 5G experience as being below expectations. mmWave 5G offers a way to improve on the current situation because the bands have extremely high capacity that are able to support very large amounts of data traffic and users, although in a small area.

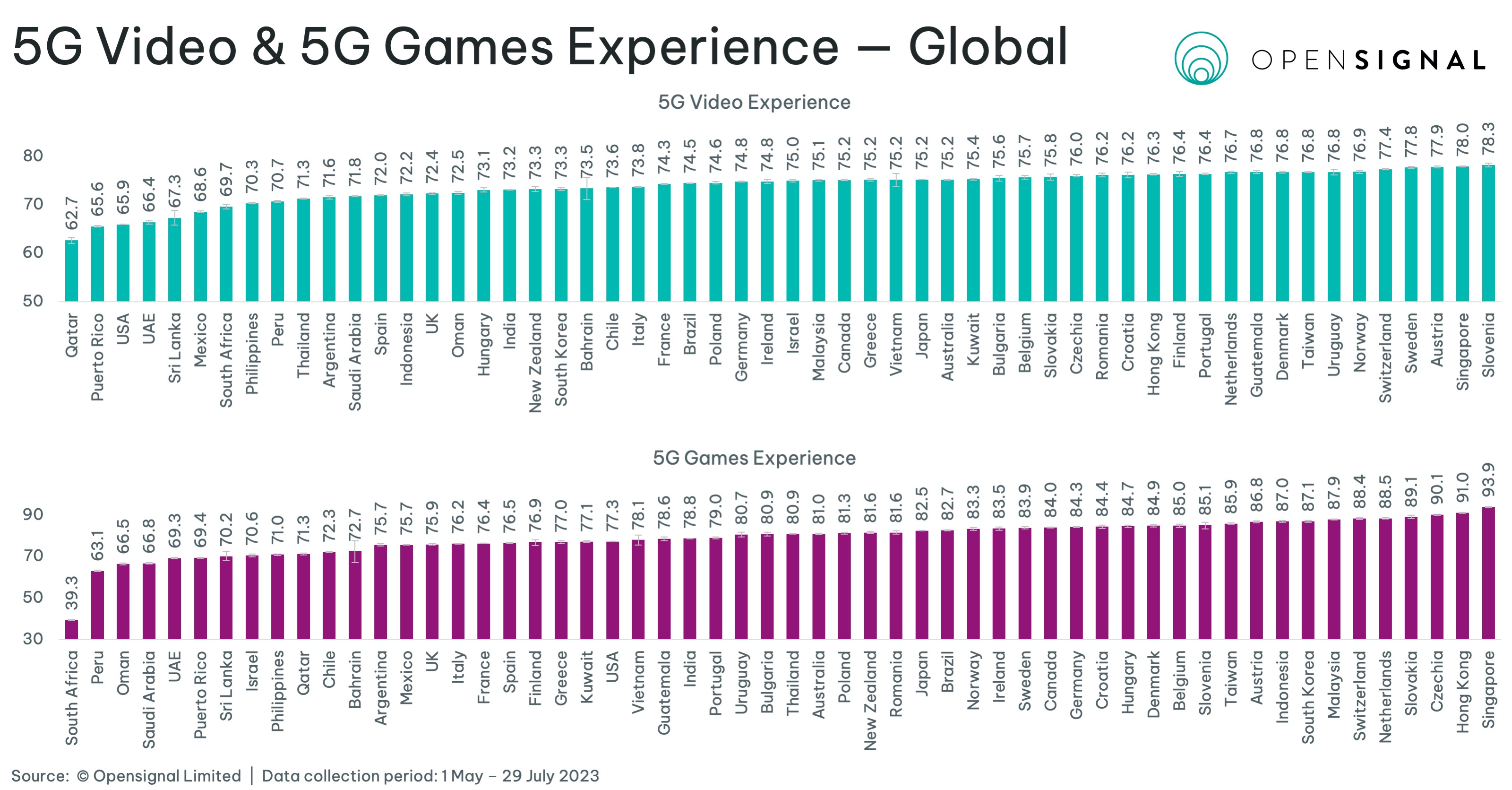

mmWave would also help South Korea improve its 5G global standing in areas where other markets are already ahead. In 5G Games Experience, Singapore tops the global rankings with a score of 93.9 on a 100-point scale followed by Hong Kong (91) and Czechia (90.1). South Korea’s score is 8th highest. When we look at the three markets with significant mmWave 5G — Australia, Japan and the U.S. — users see an improvement in their multiplayer gaming score of 7%, 6% and 12% respectively with mmWave over all types of 5G.

As with 5G Games Experience, South Korea is also not among the top markets for 5G Video Experience. The global 5G leaders are Slovenia (78.3), Singapore (78) and Austria (77.9). South Korea ranks a lowly 37th out of 56 markets where Opensignal has analyzed the 5G Video Experience. Yet, in those three markets with mmWave deployments, users’ mobile video streaming experience is 7%, 3% and 11% better with mmWave 5G than it is with overall 5G.

Speeds are much higher with mmWave 5G too. Average download speeds are between 1.6 and 3.6 times faster with mmWave, and upload speeds also improve by between 1.7 times and 2.4 times. When South Korean operators are able to offer mmWave, it will help them to be even more competitive globally. However, mmWave is not a panacea because the time users spend connected to mmWave is low. It is a valuable complement to mid and low 5G bands.

South Korean users have extremely fast average 5G download speeds already. Across all three Korean operators, users see overall 5G download speeds that are in excess of 400Mbps — this is the only market in the world where all the operators achieve this mark. However, with mmWave 5G, the experience can be even faster. Users on two U.S. operators have an even faster experience using mmWave 5G. Notably, users on these two see mmWave 5G speeds that are 5.2 times and seven times faster than users’ overall 5G download speeds on those U.S. operators.

The 5G Video Experience of the three South Korean operators places in the Very Good category (68-78). However, with mmWave U.S. operators become competitive with South Korea. The 5G mmWave experience is between 5% and 13% better with mmWave on U.S. operators compared with overall 5G.

Comparing the overall 5G experience highlights there are strong foundations in South Korea. The time 5G users spend connected to 5G is 42.3%, only slightly behind Puerto Rico. This means that not only are 5G speeds already high in South Korea, but users can experience them very often. Other markets with very high 5G Availability include smaller markets such as Singapore (30.9%) and Hong Kong (26.1%). However, there are also a number of larger markets that have impressive 5G Availability scores given the challenges of deploying a new network technology across a large land area such as the U.S. (31.3%), India (34.1%) and Saudi Arabia (22.7%).

South Korea retains the top spot in global 5G download speed (427.1Mbps), ahead of Singapore (375.5Mbps) and Brazil (357.8Mbps). The latter is notable as when 5G initially launched in Brazil, average 5G speeds were low — in early 2022 Brazil’s 5G Download Speed was just 51.7Mbps as operators relied on existing spectrum and dynamic spectrum sharing (DSS) for 5G. Since then, operators have been able to deploy new spectrum that has greatly boosted the 5G experience. This lack of new 5G-specific spectrum explains why a number of markets in Opensignal’s global analysis see relatively low 5G speeds today, for example, Peru (49.1Mbps), Argentina (55.2Mbps) and Poland (82.9Mbps).

However, in all markets, average 5G download speeds are considerably faster than speeds using 4G. The difference ranges from 1.9 times faster up to a staggering 18.6 times faster in India where 5G services launched in October 2022. Typically, in markets where 5G is well established with sizable adoption, the improvement in average download speeds with 5G is 3-6 times faster than 4G.

5G Peak Download Speeds are even higher than average 5G download speeds. In Bahrain and the U.S. users’ peak speeds are over 1Gbps, with scores of 1316.4Mbps and 1194.2Mbps respectively. South Korea is third with 933.5Mbps.

The improvement with 5G experience over older 4G is not limited to speed. There are significant, although smaller, boosts in the video streaming and multiplayer gaming experience with 5G. On Video Experience, Sri Lanka (36.8%), Malaysia (25.1%), India (24%) and Chile (24%) see the biggest uplift. For Games Experience, Peru (29%), Sri Lanka (28.7%) and India (27.4%) top the uplift rankings.

A common theme in Opensignal’s 5G global benchmark analyses has been the importance of securing large quantities of new spectrum for 5G usage to drive better levels of mobile network experience. 5G new radio enables many new higher frequency bands to be used to connect smartphone users, which are not usable with older 4G and 3G technologies.

mmWave is very high frequency — South Korean operators had licenses in the 28GHz band — and there are very large amounts of new capacity available in these bands, typically hundreds of MHz. While mmWave offers opportunities to boost the experience now, it is also an important experience indicator and test for the 6G era where more high frequency bands are candidates for 6G use, for example the extremely high frequency terahertz bands, that are higher even than mmWave bands, as well as the 7-24GHz bands.

mmWave is a forerunner of the future wireless market we will see in the 2030s. To ensure 5G experience leadership in the second half of the 5G era, as well as to prepare for 6G in the next decade, operators and markets can gain an advantage by embracing mmWave bands now.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].