In Italy Opensignal analytics shows users who switched mobile operators (Leavers), were able to find significantly better 5G network availability on their new operator, when leaving three out of the four operators. The story was different for users’ average 5G download speed – Leavers found speed deteriorated after switching from the two operators that are leading the market for 5G speeds.

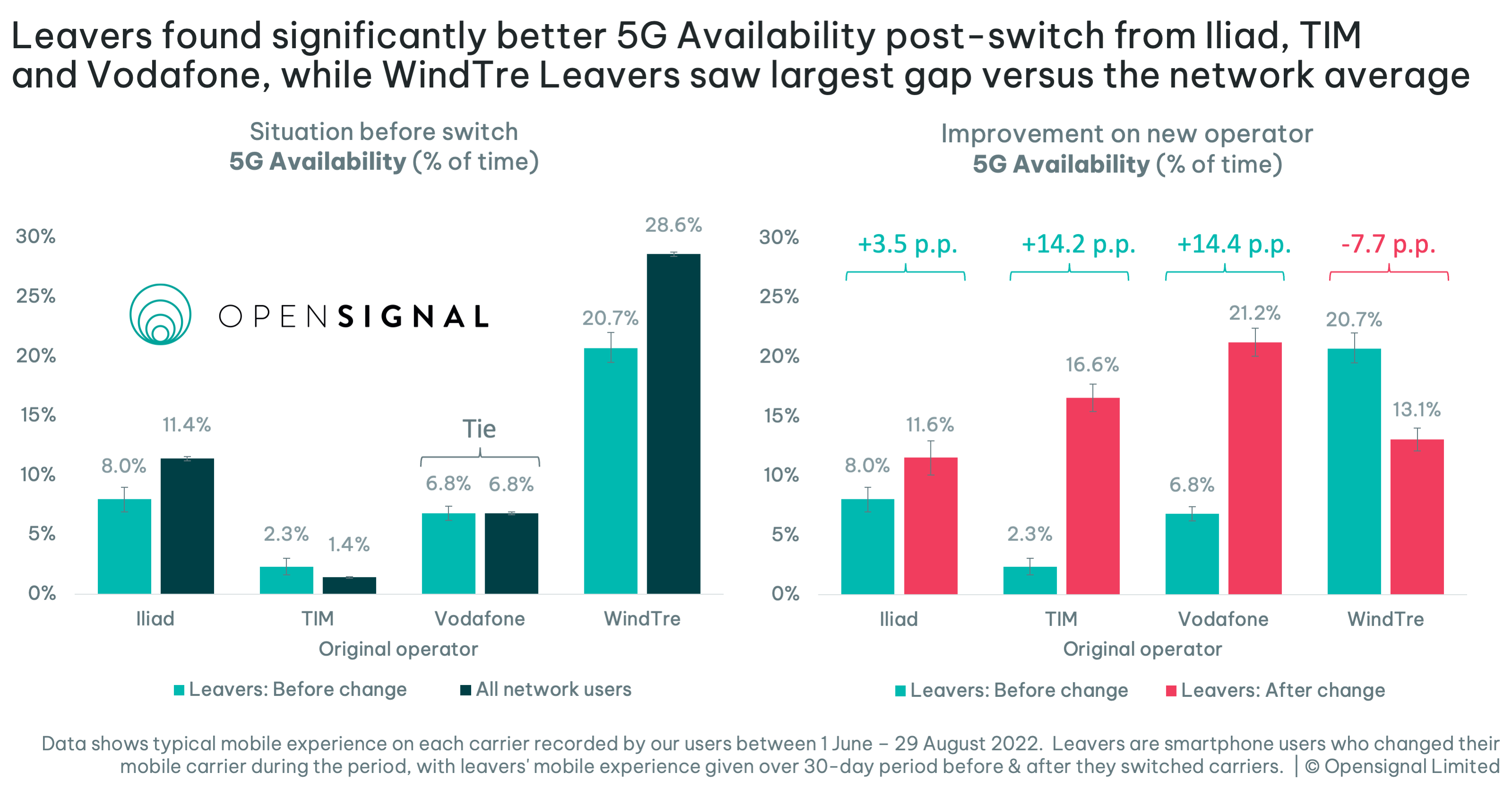

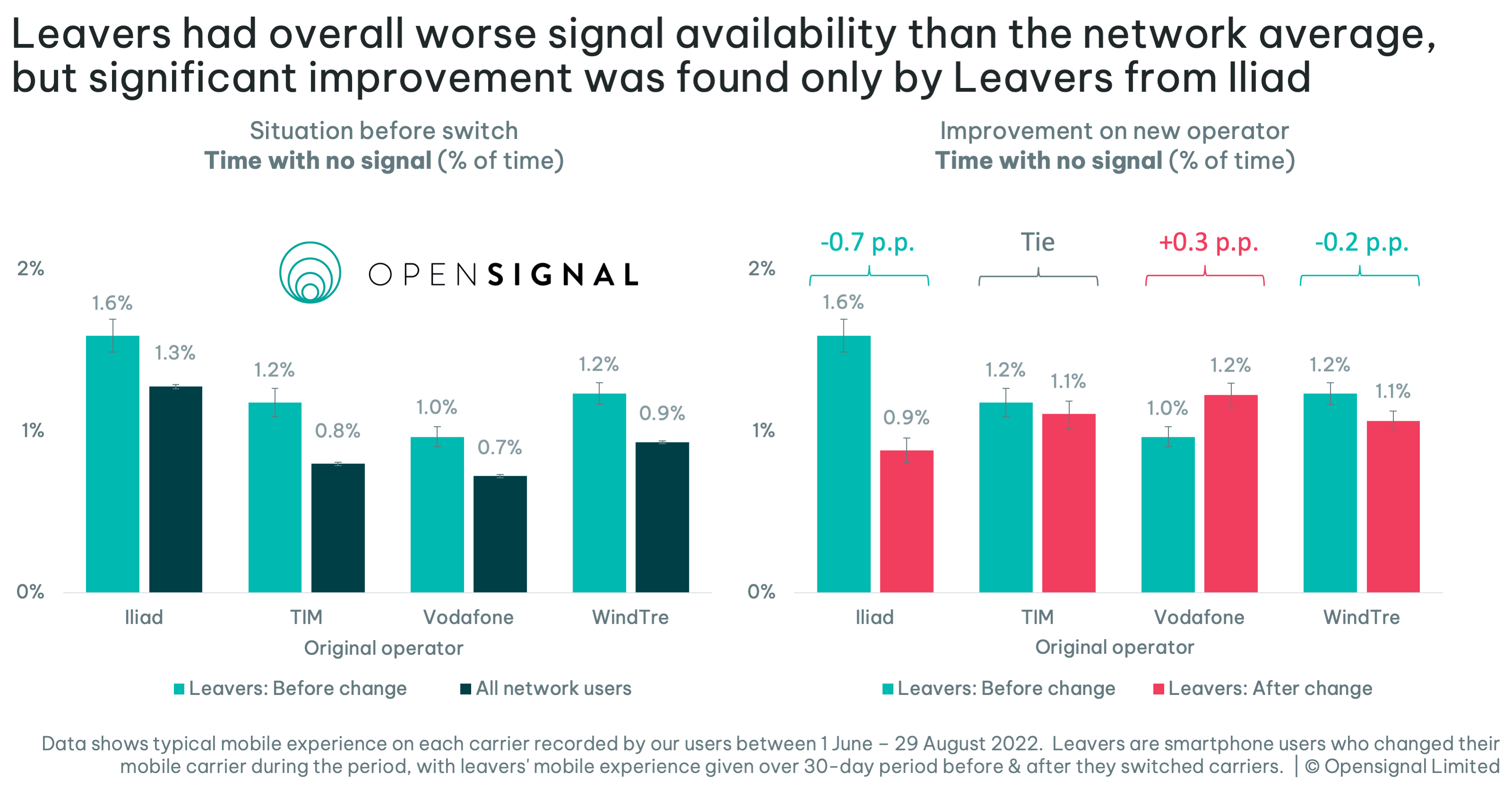

Leavers also spent more time with no signal, compared to all users of the respective network on average. However, when Opensignal previously covered churn in Italy in 2020, time with no signal played a bigger role in explaining customer churn in the Italian market. Now, 5G contributes significantly in explaining the experience gap among Leavers. In the case of two of the operators, 5G Availability was lower than the network average by 3.3 and 7.9 percentage points, among users who departed the networks. In the case of Leavers from the other two operators, their 5G Availability improved by over 14 percentage points post-switch.

Leavers from TIM and Vodafone saw the most dramatic improvement in 5G Availability after switching to a new operator, registering increases of over 14 percentage points in both cases. Leavers from Iliad also recorded improvement post-switch, but by a lesser margin of 3.5 percentage points. 5G Availability shows the proportion of time Opensignal users with a 5G device and a 5G subscription had an active 5G connection.

WindTre is far ahead in 5G Availability, winning both the 5G Availability and 5G Reach awards in the latest Italy mobile network experience report. Similarly in this analysis our WindTre 5G users spent the leading 28.6% of time with an active 5G connection. However, prior to switching, WindTre Leavers had recorded the widest difference compared to an average network user.

TIM users recorded the fastest 5G download and upload speeds in Italy in our latest market report, with the runner-up being Vodafone. Leavers from those operators did not observe faster download speeds elsewhere. In fact, their 5G Download Speed deteriorated by 66% in the case of TIM, and by 39% for Vodafone users. Leavers from Iliad and WindTre, which are lagging in this metric, recorded improvement after their switch. Similarly, for Download Speed Experience, Leavers from Iliad and TIM – the lower scoring operators for Download Speed Experience, experienced a speed improvement of over 20% on their new operator.

Across all four national operators – Iliad, TIM, Vodafone, and WindTre — Leavers spent up to 1.5 times more time with no signal compared to the average experience. After switching operator, only users who departed Iliad, WindTre and Vodafone saw improvements in the amount of time they spent with no signal. The proportion of time having improved by 0.7 and 0.2 percentage points, respectively.

This new Opensignal analysis demonstrates the importance of mobile network experience in understanding churn in Italy. Retaining and capturing the flow of customers from competing networks is vitally important, as the Italian market is highly saturated with only 0.6% annual growth in mobile handset SIM cards according to the latest market figures from the regulator AGCOM. There are local differences in mobile network experience which operators can exploit by pursuing more localized strategies in addressing local market shared and mobile network experience disparities, as Opensignal discussed in a recent Opensignal analysis that focused on the strategic positions of the operators across 21 Italian cities.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].