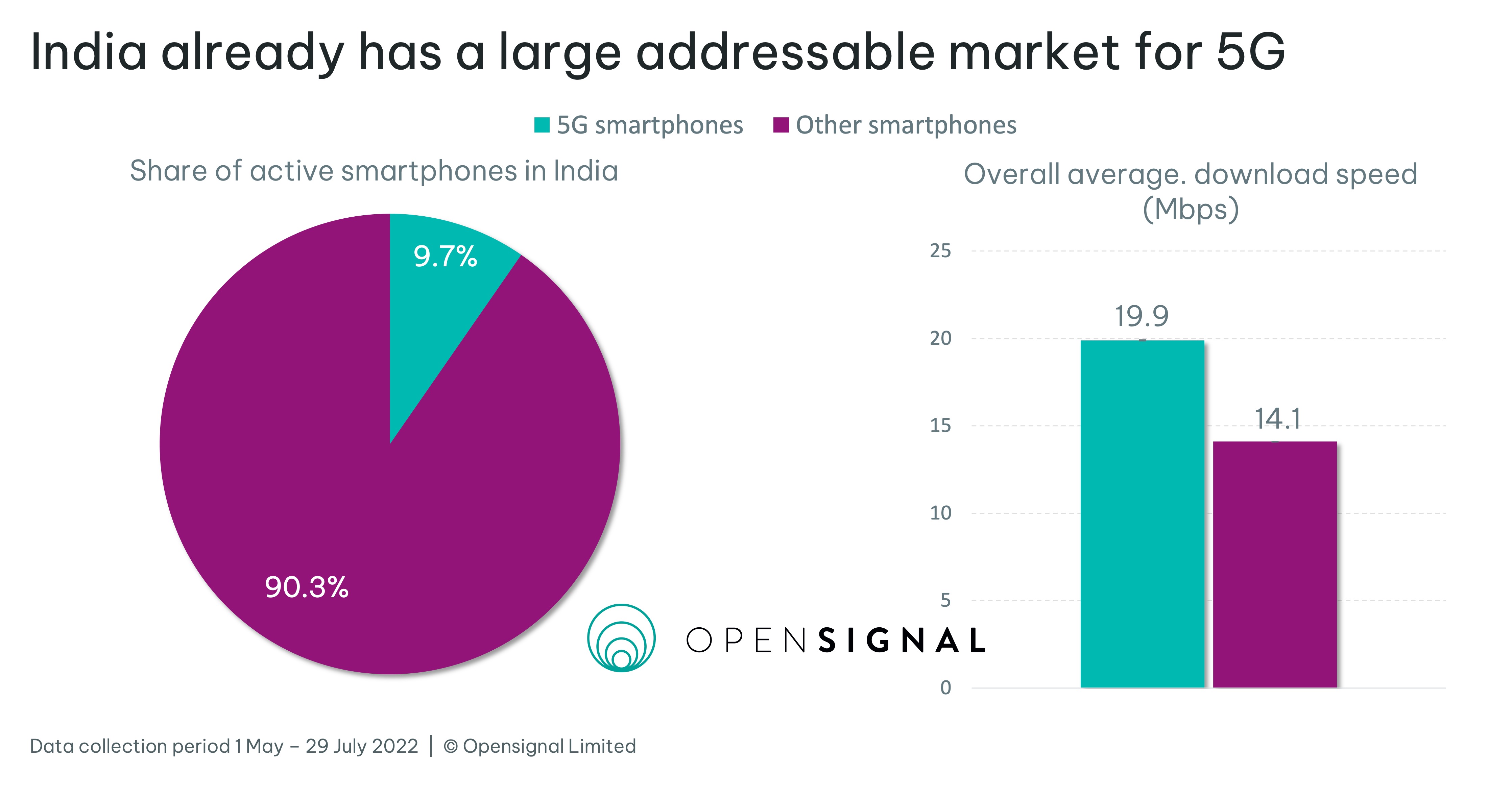

India is one of the largest telecom markets in the world — with over a billion active wireless subscribers — and is on the brink of the 5G revolution. Opensignal's latest analysis reveals that a large addressable market already exists for the operators in the country as many people already use 5G-capable smartphones. Approximately 9.7% of smartphones in use in India are 5G-capable, meaning that 5G uptake could explode very quickly as these users do not need to buy new smartphones to be able to take advantage of 5G services.

Last month, India concluded its long-awaited 5G spectrum auctions, generating USD19 billion from the sale of frequencies in the 700 MHz, 800 MHz, 1800 MHz, 2100 MHz, 3.5 GHz and 26 GHz bands. While Jio and Airtel walked away with most of the spectrum, Vodafone pursued a slightly different strategy, purchasing frequencies worth $2.4 billion but only in selected markets. Additionally, Adani Data Networks purchased approximately $27 million of spectrum in a handful of markets which it will use to offer private 5G network services. Almost immediately after the auction, the Department of Telecommunications (DoT) issued spectrum assignment letters, requesting mobile operators prepare for the launch of 5G services in the country.

Opensignal data shows that 9.7% of smartphones in use across India are 5G capable, and already today, users of these high-specification devices experience 40.8% faster download speeds, on average than non-5G devices. However, these experiences vary significantly at the circle (Licensed Service Areas) and city levels.

Looking at the proportion of 5G-capable smartphones by circles, we found that Andhra Pradesh has the greatest number 5G smartphone models, representing 14% of all 5G-capable smartphones in the country, followed by Bihar (9.3%), Maharashtra (8.5%) and Gujarat (7.7%). Meanwhile, Delhi is the first Metro circle to appear on the list, in the 7th slot, with 6.7% — 0.5 percentage points behind Category B circles of Rajasthan and Uttar Pradesh. Madhya Pradesh, Uttar Pradesh (West), and Karnataka, all three have 5.3-5.9% 5G capable smartphones in India. On the other hand, Mumbai and Kolkata Metro circles are further behind with 3.6% and 1.2% of smartphones available in India, respectively.

Further, when we look at the average overall download speeds experienced by 5G-capable smartphone users by telecom circle, we found that these users typically see 30.9%-53% faster speeds than non-5G smartphone users. This shows that users are already benefiting from shifting to modern smartphone models, as 5G models tend to be new and so have better specifications such as up-to-date modems, chipsets and radio design that also enable a high-quality 4G experience.

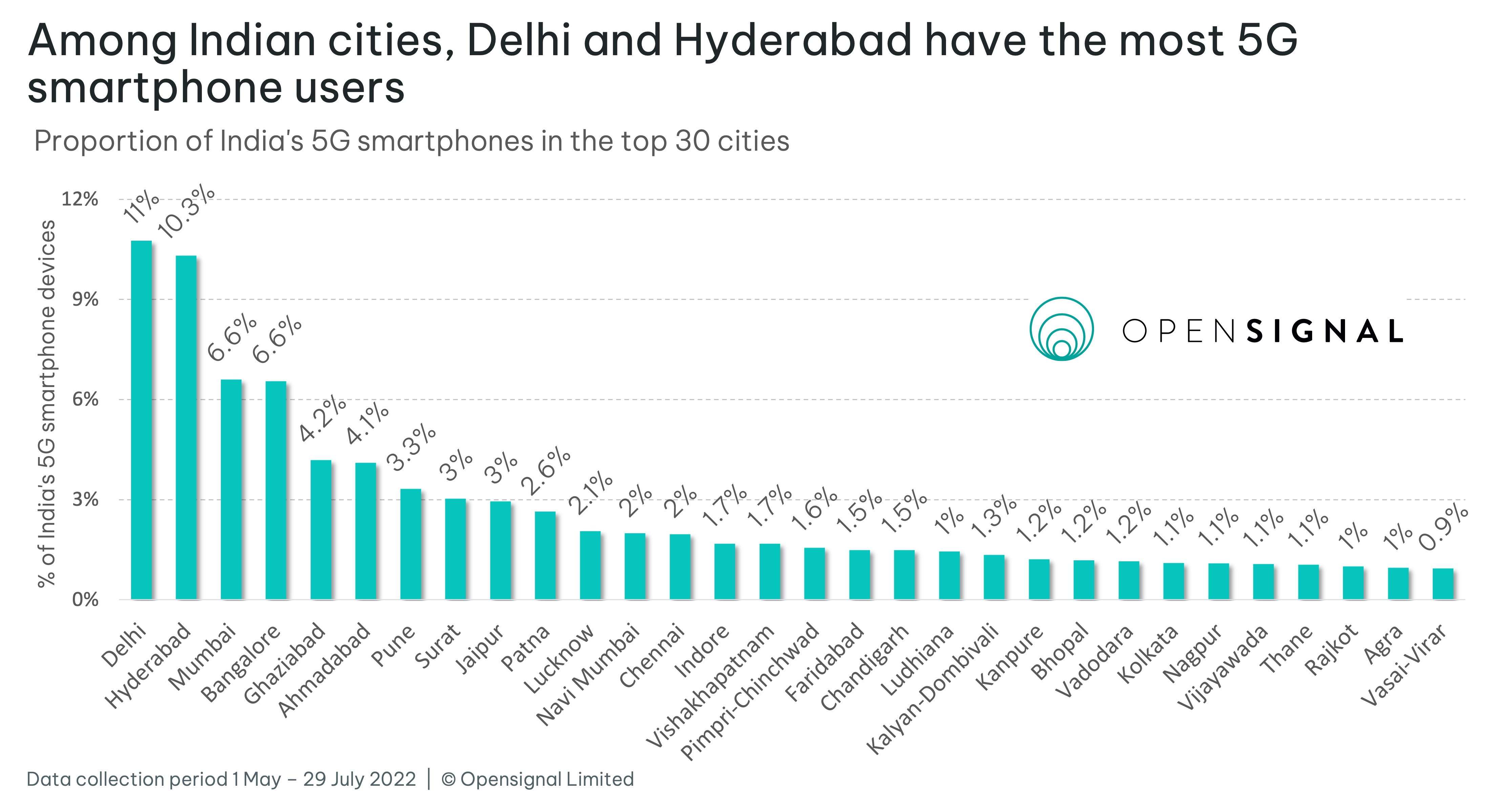

Next, we delved deeper and looked at the proportion of 5G-capable smartphones across Indian cities. Indian mobile operators' initial launches are expected to focus on cities and urban areas since they will get the fastest return on investment by deploying and upgrading their networks in dense urban areas first, as that allows them to quickly reach the most users.

Our analysis shows that, among cities, the national capital, Delhi, is home to the largest proportion of India’s 5G-capable smartphone hardware (10.8%), just slightly ahead of Hyderabad (10.3%), which is one of the biggest tech hubs in the country. Mumbai and Bangalore are next on the list with identical proportions of 5G-capable devices — 6.6% — followed by Ghaziabad (4.2%), Ahmedabad (4.1%), Pune (3.3%), Surat (3%) and Jaipur (3%). Together these nine cities make up more than 50% of India’s 5G-capable smartphones. This indicates that Indian operators have the greatest opportunity to acquire 5G users by launching commercial 5G services in these cities early on.

Like the analysis by the telecom circle above, we also assessed the average overall download speeds experienced by 5G-capable smartphone users across 30 Indian cities and found that on average 5G-capable smartphone users report 39.2%-59.3% faster download speeds than non-5G smartphone users. The speeds seen by our 5G capable smartphone users ranged from 16 Mbps in Vasai-Virar to 24.7 Mbps in Vadodara.

The findings from this latest Opensignal analysis show that India already has a large addressable market for 5G, not just in urban but also in peri-urban/rural areas. Additionally, it suggests that the uptake of 5G services in India could be relatively rapid compared to many other markets once these services are launched commercially. Therefore, there is a massive opportunity at hand for the Indian mobile operators, as they could quickly gain 5G subscribers by strategically rolling out services in cities/circles (LSAs) with higher proportions of users that already own 5G-capable smartphones. This also means that Indian operators have a strong incentive to compete to offer the most attractive 5G plans.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].