India is a large and diverse market. In fact, it is the world's second-largest telecommunications market, with over a billion active wireless subscribers with varying purchasing power and communication needs. Likewise, India's 22 designated telecom circles (licensed service areas) are also very different in terms of consumers’ willingness and ability to pay across the range of digital services. Hence the government of India has grouped these LSAs circles into four categories — Metros, Categories A, B and C — based on revenue-earning potential and extant state boundaries.

In this analysis, we examined the mobile network experience in 22 telecom circles in the country to see how they compared across different aspects of mobile network experience. Their scores are based on the combined results of all national operators across different mobile network generations.

Category A circles in Peninsular India enjoy some of the top download speeds

At the top of our list for overall mobile download speed is Andhra Pradesh; our users in this circle saw the fastest mobile download speeds in India, clocking in at 15.2 Mbps. Meanwhile, its two neighboring Category A circles from Peninsular India were close behind. In second place is the Silicon Valley of India, Karnataka, with a score of 14.9 Mbps, while Tamil Nadu makes it to the top four with speeds averaging 14.1 Mbps. Jammu and Kashmir is the only other circle where users reported speeds above 14 Mbps, the Category C circle places third.

While our users in Andhra Pradesh saw download speeds at least 16.1% faster than the national average (13.1 Mbps), those in Category B circles — Uttar Pradesh, Rajasthan and Haryana — as well as in Category C circle of Orissa, also saw speeds greater than the national average. In contrast, users in the Metro circles of Delhi and Mumbai saw speeds lower than the national average, and those in Kolkata reported no statistically significant difference compared to the national average. Meanwhile, the disparity between circle scores and national results was greater in Assam and the North-East circle. The North-East circle places at the bottom of the table with an average download speed of 10 Mbps — 23.4% lower than the national average.

Rajasthan leads the pack on upload speed

While fast download speeds are essential, upload speeds are also becoming an increasing aspect of users' mobile network experience, with changing usage patterns and consumption habits. For example, mobile users now make extensive use of social media apps, creating and sharing high-resolution images and videos, giving operators with the fastest upload speeds a distinct advantage.

Opensignal's latest analysis shows that users in the Rajasthan circle see the fastest average upload speeds of 4.9 Mbps in India — 0.5 Mbps faster than those seen across the country. In fact, users in nine circles reported upload speeds higher than the national average, including the neighboring circle of Gujarat, all three category A circles in South India, and two Metro circles — Kolkata and Mumbai.

Like download speeds, Karnataka and Andhra Pradesh also place in the top five for average upload speeds. Assam and North-East also lag in terms of upload speeds. Our users in both circles North-Eastern circles experienced speeds that are 37.5-43.3% lower than the national average.

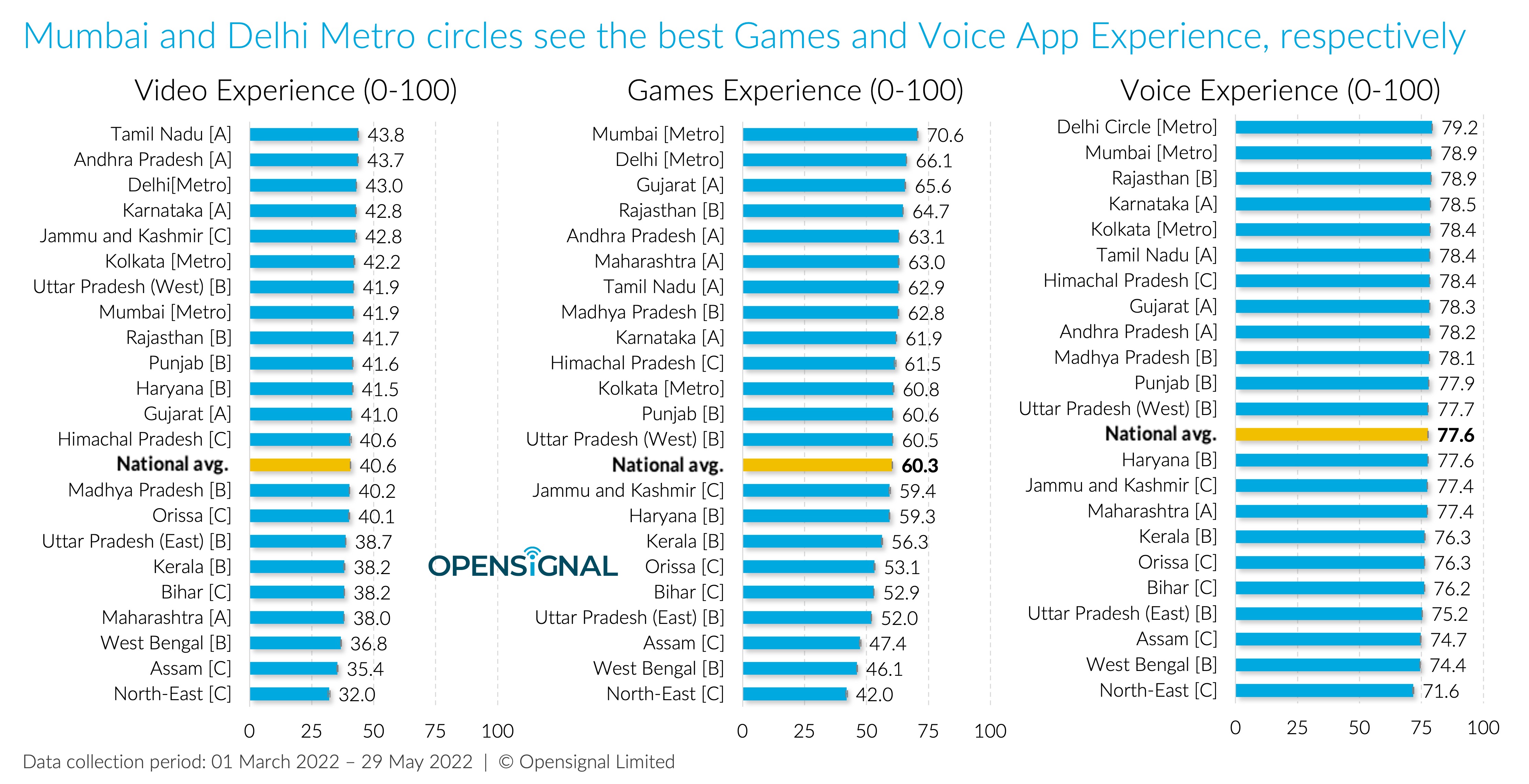

Delhi Metro circle claims a spot in the top three for mobile Video, Games and Voice App Experience

In Video Experience, Tamil Nadu and Andhra Pradesh came neck and neck with joint-top scores of 43.8 and 43.7 points (out of 100), meaning smartphone users in both these circles enjoyed the best experience when streaming video over mobile connections in India. Delhi Metro and Karnataka follow close behind with a slightly lower score of 43 and 42.8 points, respectively. At the same time, Jammu and Kashmir is the only Category C circle to place in the top five for Video Experience. With these scores, all five circles earned a Fair Video Experience rating.

In fact, a total of 15 out of 22 circles in India garnered a Fair Video Experience rating (40-55), in line with the national Video Experience, while the seven remaining circles rated one category lower. Opensignal's Video Experience directly assesses video streams from end-user devices and uses an International Telecommunication Union (ITU)-based approach to quantify the overall video experience for each operator on a scale from 0 to 100. The videos tested include a mixture of resolutions and are streamed directly from the world's largest video content providers.

Our users in Mumbai metro circle enjoyed the best Games Experience in India while playing multiplayer mobile games — ahead of those in Delhi Metro and Gujarat. All these circles placed in the Fair (65-75) category in terms of mobile gaming experience, which means users found the experience to be average and in most cases, the game was responsive to the actions of the player. Turning to Voice App Experience, Delhi Metro circles reign superior in the country, with a score of 79.2 points. Our users across all Indian circles enjoyed an Acceptable (74-80) quality of experience while using over-the-top (OTT) voice app services such as WhatsApp, Skype, and Facebook Messenger — except for North East, which placed in a category below.

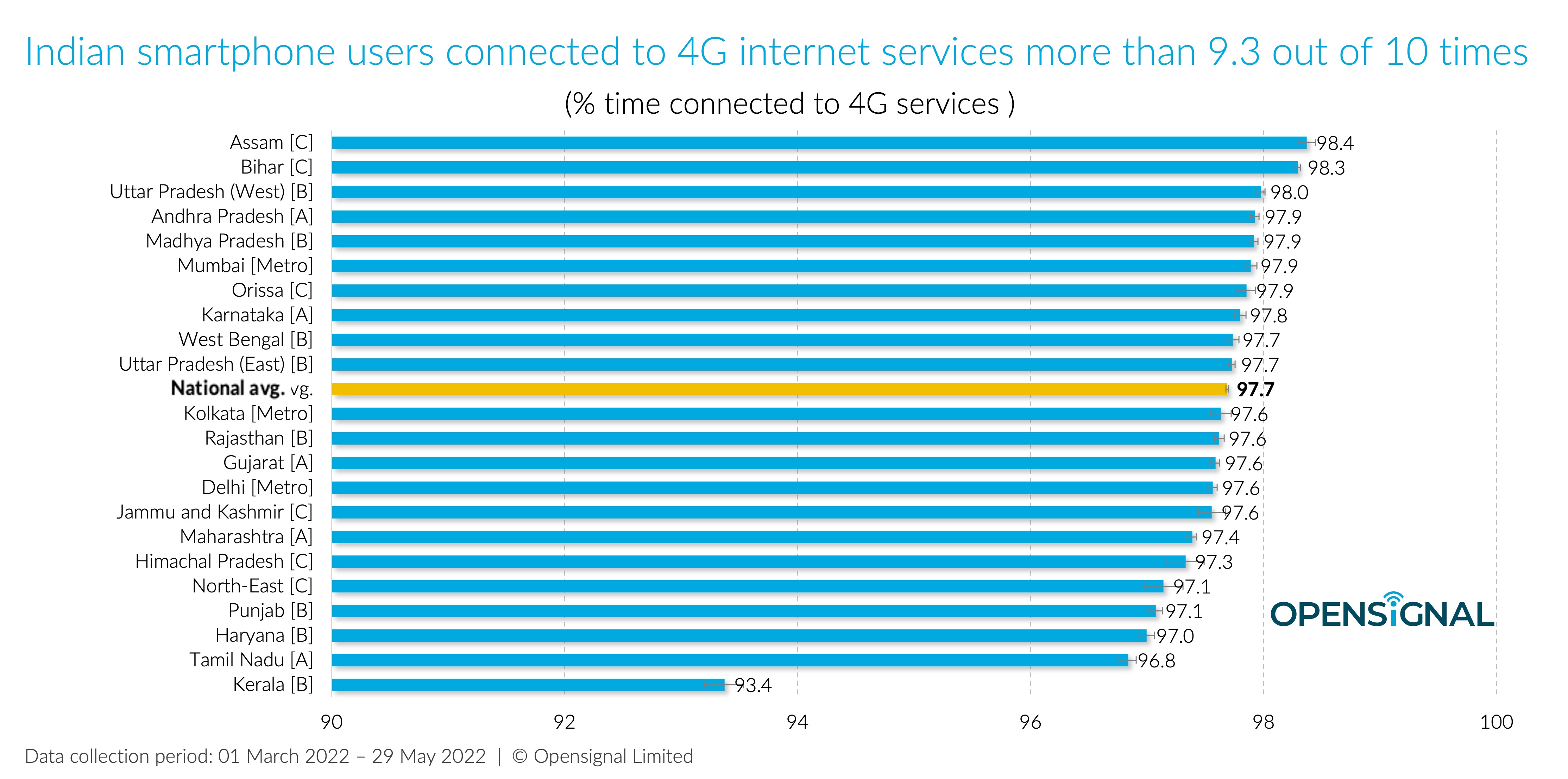

Users in Category C circles of Assam and Bihar spend the greatest time connected to 4G

Our analysis of 4G Availability shows that Indian smartphone users spent an incredibly high proportion of time connected to 4G data services — this is not surprising given India has reported some of the highest 4G Availability globally. We found that users in all 22 circles spent at least 93.4%, with users in at least 20 out of 22 circles spending 97% or more of the time connected to 4G. Assam and Bihar are joint top on this measure with statistically tied scores of 98.4-98.3% — less than one percentage point greater than the national average.

Overall, our analysis of Indian mobile network experience highlights the differences in mobile network experience across India's telecom circles, likely due to regional spectrum assignments and diverse communication needs, among other factors. With the 5G auctions around the corner, India has an excellent opportunity to close the regional gaps in mobile network experience by ensuring a framework that helps minimize differences between circles, enabling equal and timely 5G access to the public.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].