In the latest Opensignal update on the 5G mobile network experience across Asia Pacific South Korea impressively tops the chart for all three measures of speed: 5G Download Speed, 5G Peak Download Speed and 5G Upload Speed. South Korean users were the only ones in the region to enjoy average 5G download speeds over 300 Mbps, in fact their speeds reached an astonishing 438 Mbps.

Taiwan ranks joint second for 5G Download Speed with New Zealand as their scores of 263.1 Mbps and 253 Mbps are statistically tied. Also, Taiwan ties for second place for 5G Peak Download Speed (614 Mbps) this time alongside Australia (597.8 Mbps), and is in a clear second place for 5G Upload Speed with 30 Mbps.

Close neighbors New Zealand and Australia are jostling for position across each measure. New Zealand is ahead on both 5G Download Speed and 5G Upload Speed but Kiwi users’ speeds came behind Australians for 5G Peak Download Speed.

In South East Asia, there is more limited availability of new 5G spectrum than in South Korea, Japan or Australia which explains lower speeds in all markets. Here, Singapore is ahead of the Philippines and Indonesia. But Singapore benefits from having a compact urban geography where 5G roll out should be easier. Also, Indonesian operators only started to launch 5G in the middle 2021, and so its results reflect a much earlier stage of the 5G market and as a result are likely to change significantly in future as Indonesian operators expand their 5G services, or, in some cases launch 5G for the first time.

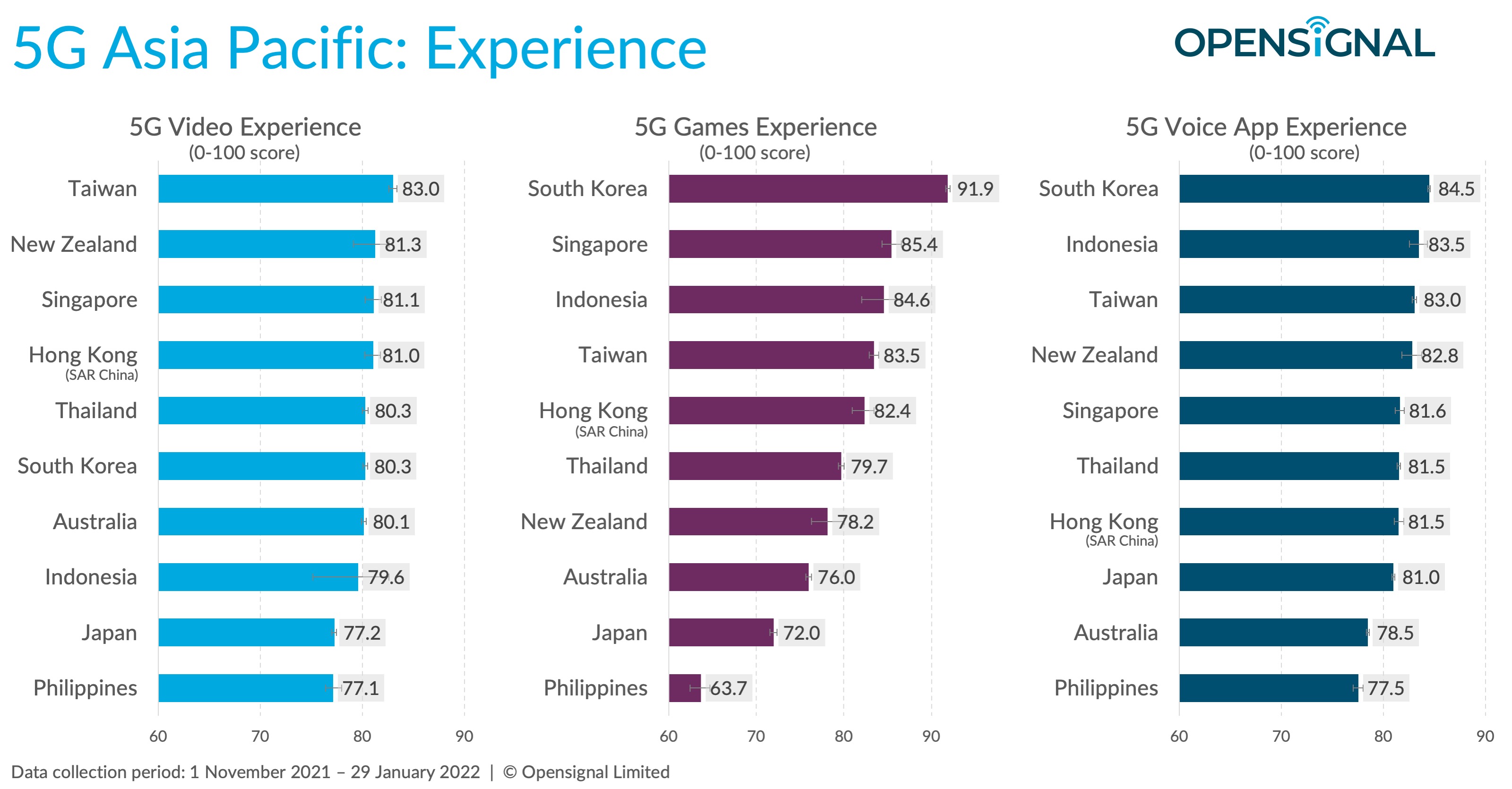

Taiwan tops the table for 5G Video Experience in Asia Pacific, with a score of 83 on a 100-point scale. Despite its lead on 5G speeds, South Korea is in the middle of the table indicating that mobile video streaming depends on more than speed alone for users to enjoy a high quality experience.

South Korea has a clear victory margin for 5G Games Experience with a score of 91.9 on a 100-point scale. However, here it is Singapore and Indonesia that are next highly ranked with statistically tied scores of 85.4 and 84.6 respectively. Multiplayer mobile gaming reveals much greater variation in scores across our users in Asia Pacific markets than we see for either mobile video streaming or for real-time communications using mobile voice apps.

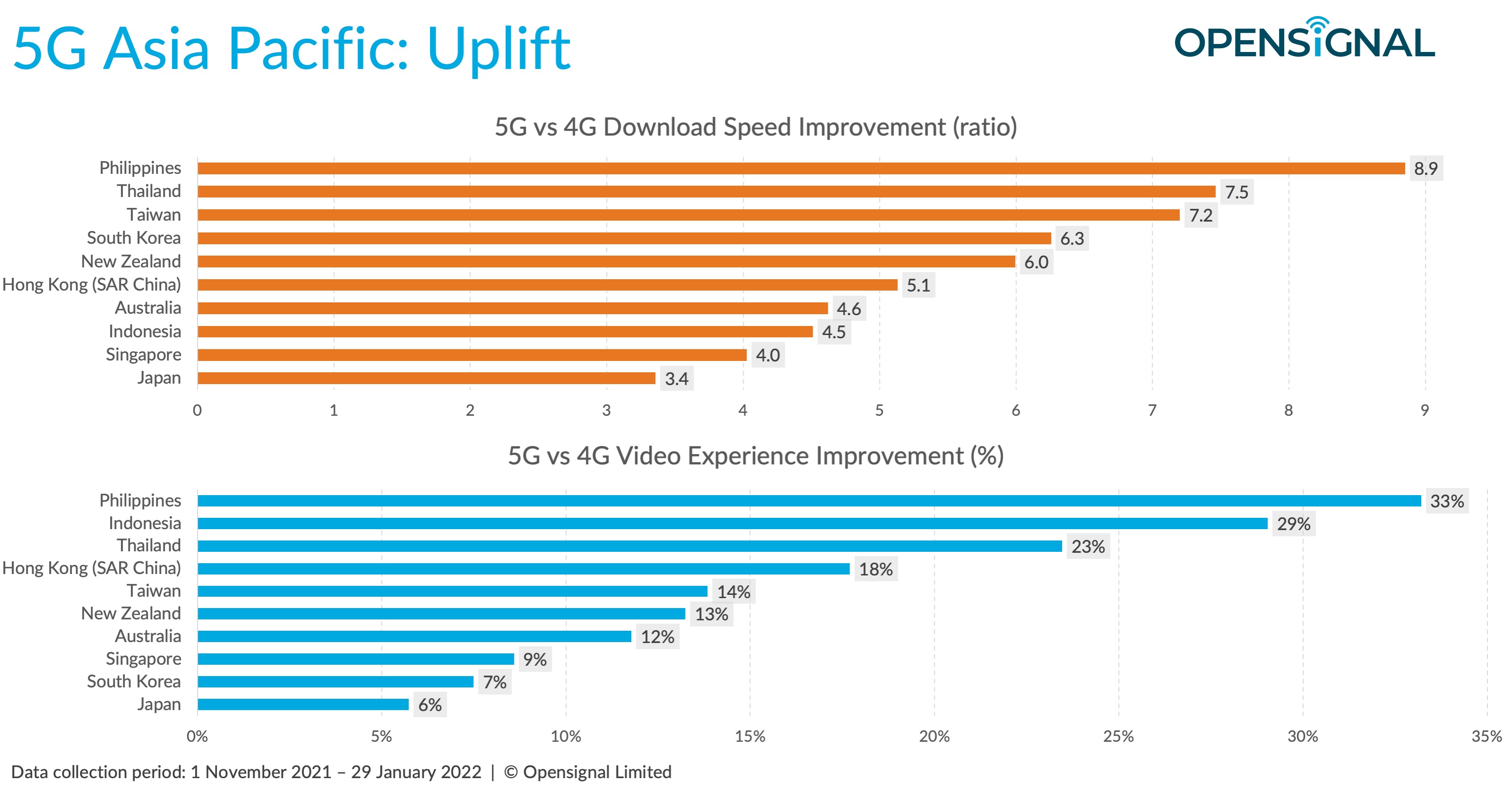

The Philippines saw the greatest uplift when we compare the 5G and 4G mobile network experience. Impressively, the average 5G download speeds seen by our users were 8.9 times faster than average 4G speeds in the Philippines. On mobile video streaming, Filipino users enjoyed a 33% higher Video Experience score using 5G versus 4G. Also, Indonesia came in second for uplift in Video Experience with a 29% higher score.

Users in all 10 markets saw a large uplift in average download speeds with 5G. Users in Thailand saw 7.5 times faster speed and in Taiwan it was 7.2 faster. Even in developed markets that have high quality existing 4G networks users saw massive increases in speeds with 5G. For example South Koreans saw 6.3 times faster speeds, Singaporeans four times faster, and Japanese users 3.4 times faster.

5G continues to mature as a technology as operators expand the extent of their 5G services. Either by boosting the geographic reach, or by deploying 5G on new spectrum bands that improve speed and capacity — if mid or higher frequency — or by boosting in-building signal propagation and rural reach through the use of lower frequency bands for 5G.

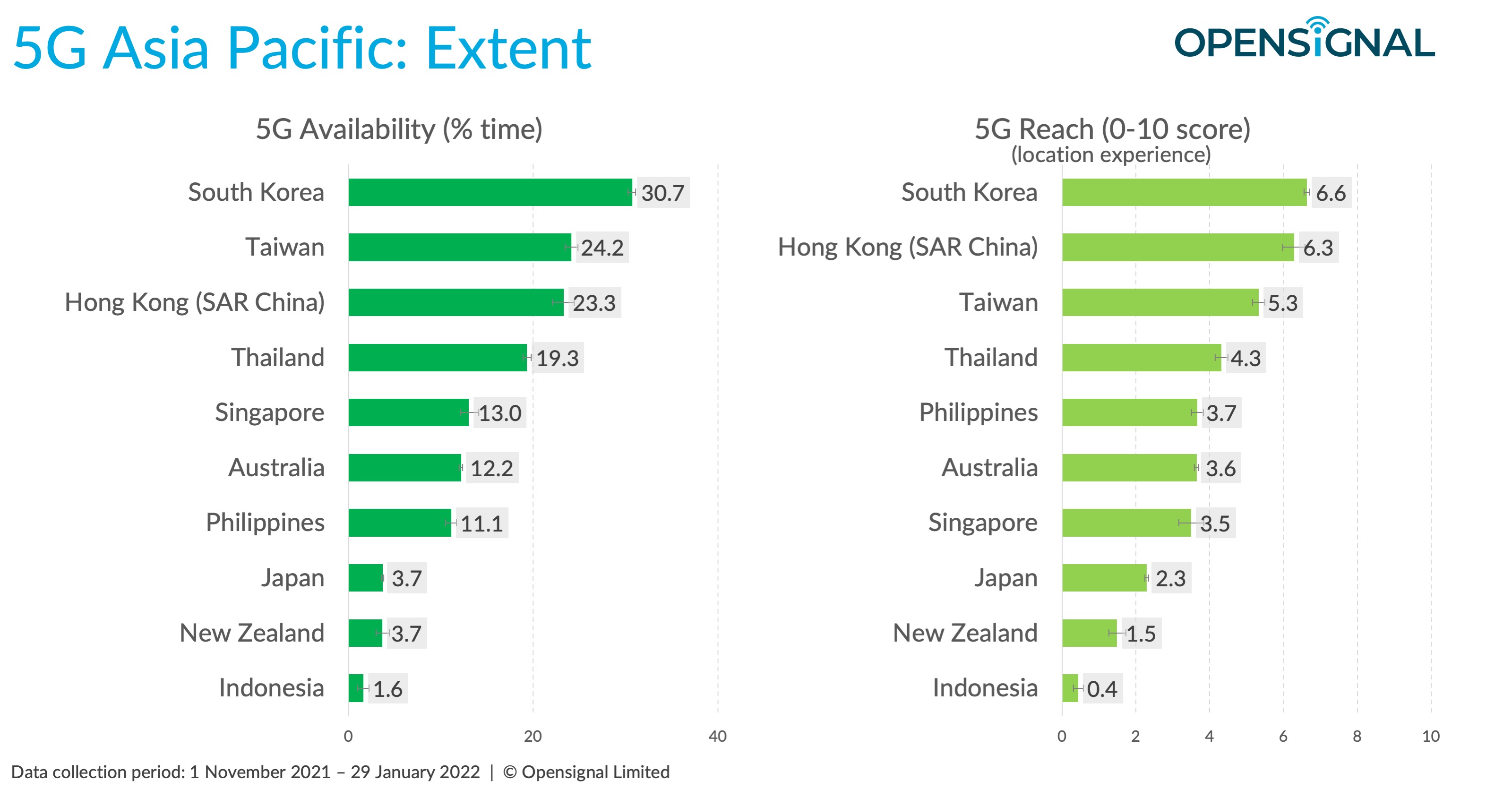

Across the region, our users experienced widely varying access to 5G services. In South Korea, users spent 30.7% of time with an active 5G connection which is an excellent 5G Availability score when we compare that globally. South Korean users also saw 5G service in approximately two thirds of the locations they visited which led to a 5G Reach score of 6.6 on a 10 point scale. Impressively, this is ahead of much smaller markets such as Singapore (13% and 3.5) and Hong Kong, at least for 5G Availability (23.3%) although Hong Kong’s score of 6.3 for 5G Reach is statistically tied with South Korea.

Two markets that are significantly more challenging to deploy mobile networks do well and place in the middle of the chart for both 5G Availability and 5G Reach. Australia, a vast market, scores a creditable 12.2% for 5G Availability and 3.6 for 5G Reach. While not as large, the numerous islands and challenging interior of the Philippines also mean that the scores of 11.1% and 3.7 are similarly impressive.

5G is the future of mobile services, although 4G remains in use everywhere, as do 3G and even 2G in some markets. Across Asia Pacific, operators are continuing to expand their 5G services because of the advantages of this latest technology in serving users. In many markets, operators have either just launched 5G services, or are preparing for their first launch. Yet the region also has markets such as South Korea where 5G soon will have its third birthday (in April).

As 5G matures, we will see dynamic changes in the 5G experience across all Opensignal’s measures. Markets will likely change in their ranking. Using Opensignal’s unique single methodology which quantifies the real-world experience of mobile users with a continuous flow of data, we will continue to gauge how users’ experience improves and changes.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].