As Indonesia’s mobile market is dominated by prepaid users, it is easy for users to switch, or churn, between operators when they are not happy with their mobile service provider because they are not tied into a contract. Indosat, Telkomsel and XL have now launched their 5G networks which will likely increase the competitive pressure in the market as operators look for a return on their 5G investments. In this new analysis we found that approximately one third of mobile users that switched operators were higher value users that operators should be seeking to retain.

In our previous analysis we found that mobile experience matters to subscribers and that it is an extremely important driver of churn in Indonesia. In this report, we have now analyzed our users’ mobile data consumption to understand if the users who are looking for a new service provider are high or low-value users for mobile operators. In fact, in a heavily prepaid market like Indonesia, the amount of mobile data consumed is generally a good indicator for the revenue that these users generate for the operators. Prepaid users consuming more mobile data will generally spend more on their mobile plan.

We looked at the average monthly data consumed by our Leavers before they switched operators and compared that against the average usage of smartphone users on their original mobile network.

Opensignal data shows that our Indonesian users on the five national mobile operators on average consumed between 14.6 and 17.7 GB a month, with our Indosat users showing the highest usage, followed by our 3, Telkomsel, XL and Smartfren users.

Interestingly, we observed that our Leavers on average consumed a lower amount of mobile data compared to the average usage on their original mobile service provider, and that was consistent across all five operators. However, the difference in average monthly data usage of our Leavers compared to all users varied, as we observed the smallest differences on XL (6.3%) and Telkomsel (9.2%), while they exceeded double-digit on Indosat (12.7%), Smartfren (17.5%) and 3 (19.3%).

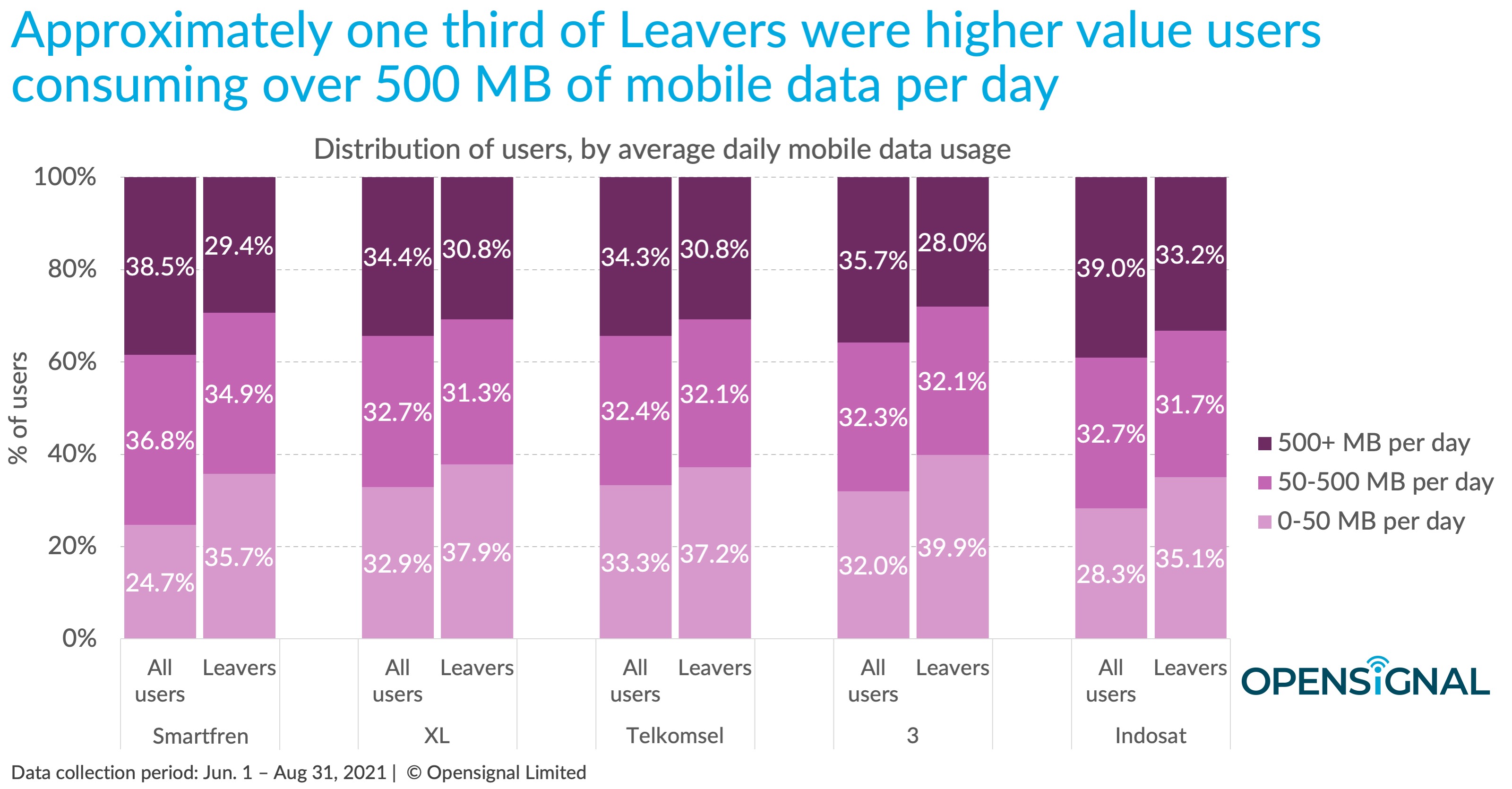

We then analyzed the distribution of Leavers by their average daily mobile data usage before they left their original mobile service provider to better understand if operators are losing high or low mobile data usage customers.

Users with higher data usage will spend more with their mobile operator. Approximately one third of users that switched operator — Leavers — were such higher value users that on average consumed more than 500 MB of mobile data per day. Across the five operators, the share of Leavers that was high value ranged between 28% of Leavers on 3 to and 33.2% on Indosat.

As we focus on the distributions of all our users on the five networks, we see that operators with a higher average monthly mobile data usage tend to have a larger share of users consuming lots of data and a lower proportion of users consuming little data. Indosat was the operator with the largest share (39%) of users in our top tier by data usage, followed by Smartfren (38.5%), 3 (35.7%), XL (34.4%) and Telkomsel (34.3%). Despite Smartfren having the second largest share of users placing in this category, those users on average consumed a lower amount of data compared to our heavy data users on the other four operators, thus resulting in Smartfren having a lower average monthly mobile data usage per user.

When we look at our Leavers’ distributions, we observe once again Indosat having the largest share (33.2%) falling into the top tier by data usage — similarly to when we analyzed all users’ distributions. However, this time Indosat was followed by Telkomsel and XL (both with 30.8%), Smartfren (29.4%) and 3 (28%). Looking at the differences in the Leavers’ proportion of heavy mobile data users against all users on each operator, we see Telkomsel and XL having the smallest differences, meaning that these two operators lost a relatively higher share of their heavy data users compared to Indosat, 3 and Smartfren.

Opensignal’s first analysis on Indonesia’s mobile churn showed that mobile experience matters to subscribers and that it is an extremely important driver of churn beyond other factors such as pricing and customer service. Now, in this new analysis we can see that some operators are doing better than others in retaining higher value users in an increasingly competitive market. However, our data also shows that the proportion of high-value users is a minority across all networks. This suggests that all mobile operators need to understand where they should first improve their mobile network experience to retain their high-value customers and attract their competitors’ ones.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].