To understand what the new normal looks like for mobile experience, Opensignal is updating our previous analysis of the impact of the pandemic and changed user behavior on the mobile experience with new data. Opensignal has previously analyzed the effect of the COVID-19 pandemic on mobile network experience and data consumption in insight notes published in April, June and October 2020.

To prevent the spread of the COVID-19 coronavirus, governments worldwide imposed lockdown measures in Spring 2020. This led to an increased global dependency on internet connectivity to facilitate work, education and social interactions. Patterns of user behavior changed as people spent more time at home, sometimes ahead of formal lockdowns, or when restrictions were eased. Consequently, we observed noticeable fluctuations in download speeds in many markets and, where users spent longer at home, greater time spent connected to Wifi.

Download speeds are above the pre-pandemic levels in many markets

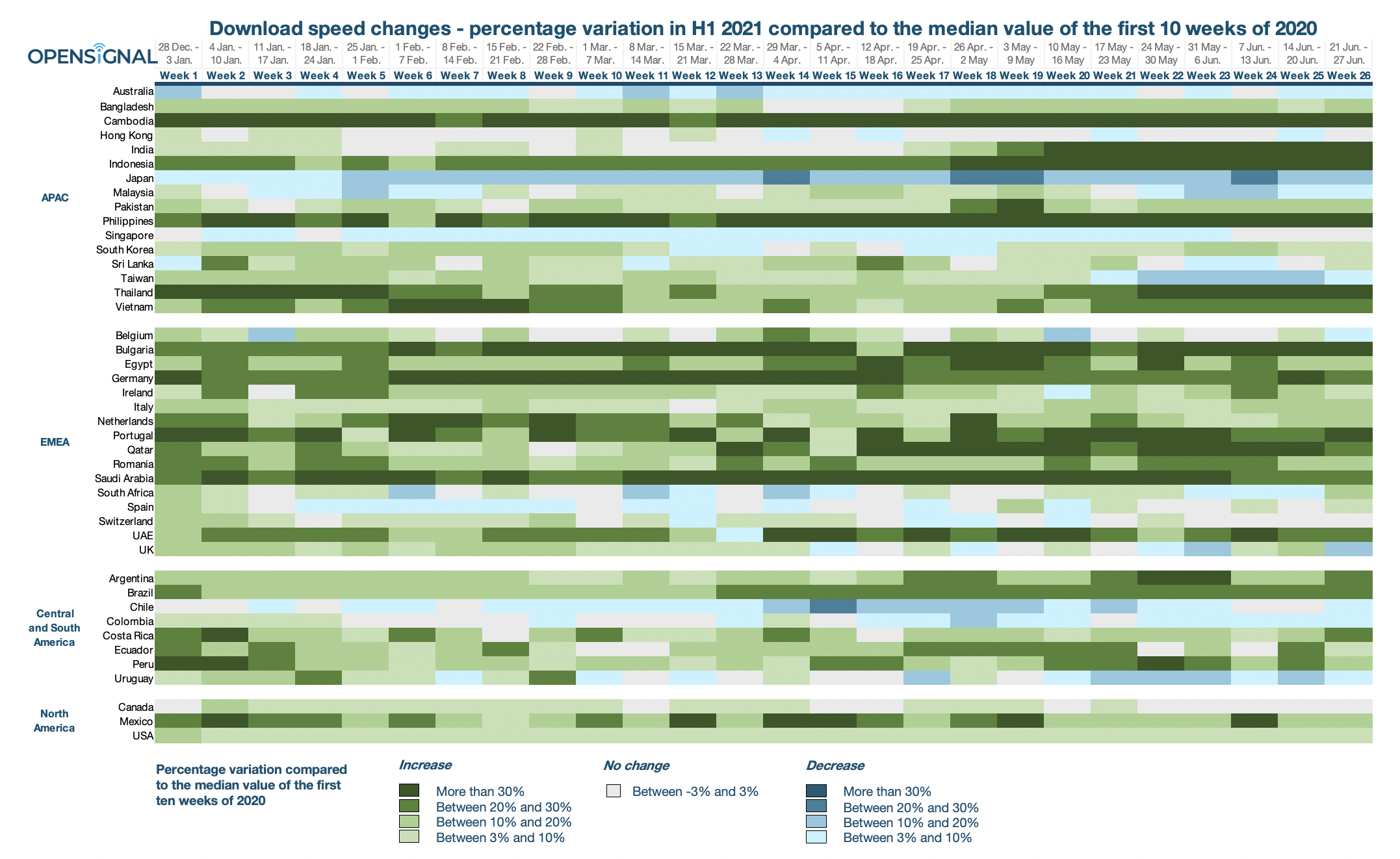

In this insight, we have analyzed average Download Speeds across Asia, Europe, MENA, Central America, South America and North America — on a weekly basis for the period of January-June 2021, compared to the pre-pandemic levels of early 2020. Noteworthy, the way COVID impacted different markets varied quite widely during this time.

Percentage variation of weekly average download speeds in 2021 as compared to the median value of the first ten weeks of 2020, i.e. between December 30, 2019 and March 8, 2020.

When we compare January to June 2021 with a pre-pandemic period of January to early March 2020, average mobile download speeds have increased for many markets around the world. For example, in the Philippines the average download speeds experienced by our users were between 19.1% and 71.3% faster, in Cambodia the increases were 24.4% or above every week. Across Indonesia they were up by at least 19.2% every week, while in Germany speeds rose by at least 22.9%. This means these markets have more than recovered from any initial declines in mobile network experience and even managed to go above the pre-pandemic levels. Of course, changes in average mobile download speeds and the overall mobile user experience may be attributed to reasons other than the global pandemic, such as additional spectrum or new infrastructure deployed.

One of the factors that would have contributed to boosting download speeds in Germany over time is repurposing the 3G spectrum in the 2100 MHz to 4G and 5G use — along with dedicating previously unused spectrum in this band. This helped to increase overall download speeds, according to our earlier research. Reactive spectrum policies have improved markets’ network resilience. Regulators in several markets assigned additional spectrum to mobile operators on a temporary basis, to provide additional capacity for the increased demand for mobile data (U.S., Saudi Arabia, Jordan). In addition, some markets have always made some spectrum bands technology-neutral to allow their use for 4G (Ireland, Tunisia).

Percentage variation of weekly average speeds as compared to the median value of the first ten weeks of 2020, i.e. between December 30, 2019, and March 8, 2020. Data collection period: December 30, 2019 – June 27, 2021

It is worth highlighting that our users in several markets such as Qatar, Saudi Arabia, UAE or Indonesia experienced notable decreases in their average download speeds during the first weeks of the lockdowns — which makes their later significant improvements in speeds even more impressive. In the case of Indonesia, increased mobile data consumption was likely one of the reasons to test the resilience of mobile networks. As our Quantifying the Impact of 5G and COVID-19 on Mobile Data Consumption report shows, our users in Indonesia consumed 8.5 GB of mobile data per month on average in Q1 2019 — and their usage increased by nearly 40% to 11.8 GB/month in Q1 2020 and to 14.4 GB/month in Q1 2021.

To improve its mobile infrastructure, Indonesia has completed several infrastructure and network upgrade projects such as the Palapa Ring to increase capacity and resilience. The government committed to fostering “national digital transformation”, by expanding 4G coverage nationwide by the end of 2022, including currently underserved rural areas. It will finance the extension of 4G coverage to remote areas through partnerships with mobile operators and the private sector. Indonesia’s Ministry of Communication and Information has started works on refarming the 2.3 GHz band to improve the quality of mobile services and lay the groundwork for the future 5G deployments.

However, average download speeds experienced by our users in some markets remained stagnant and either oscillated around pre-pandemic (January-February 2020) levels of average download speeds or have yet to return to them — like in the case of Chile, Colombia, Australia or Hong Kong. In Japan, overall download speeds are consistently lower than pre-pandemic levels. In Taiwan, Malaysia, and Singapore we see lower speeds during this most recent period — especially in June — indicating that the changes in the experience that correlate with the pandemic are unfortunately not yet over.

There may be a variety of reasons for download speeds stagnating in some markets — inefficient network infrastructure that can’t cope with increased data consumption; not enough spectrum assigned to mobile services; citizens migrating from urban to rural areas — where there is less mobile network infrastructure — to stay with families during the lockdown.

Time on Wifi declined over time and is now lower than before the pandemic

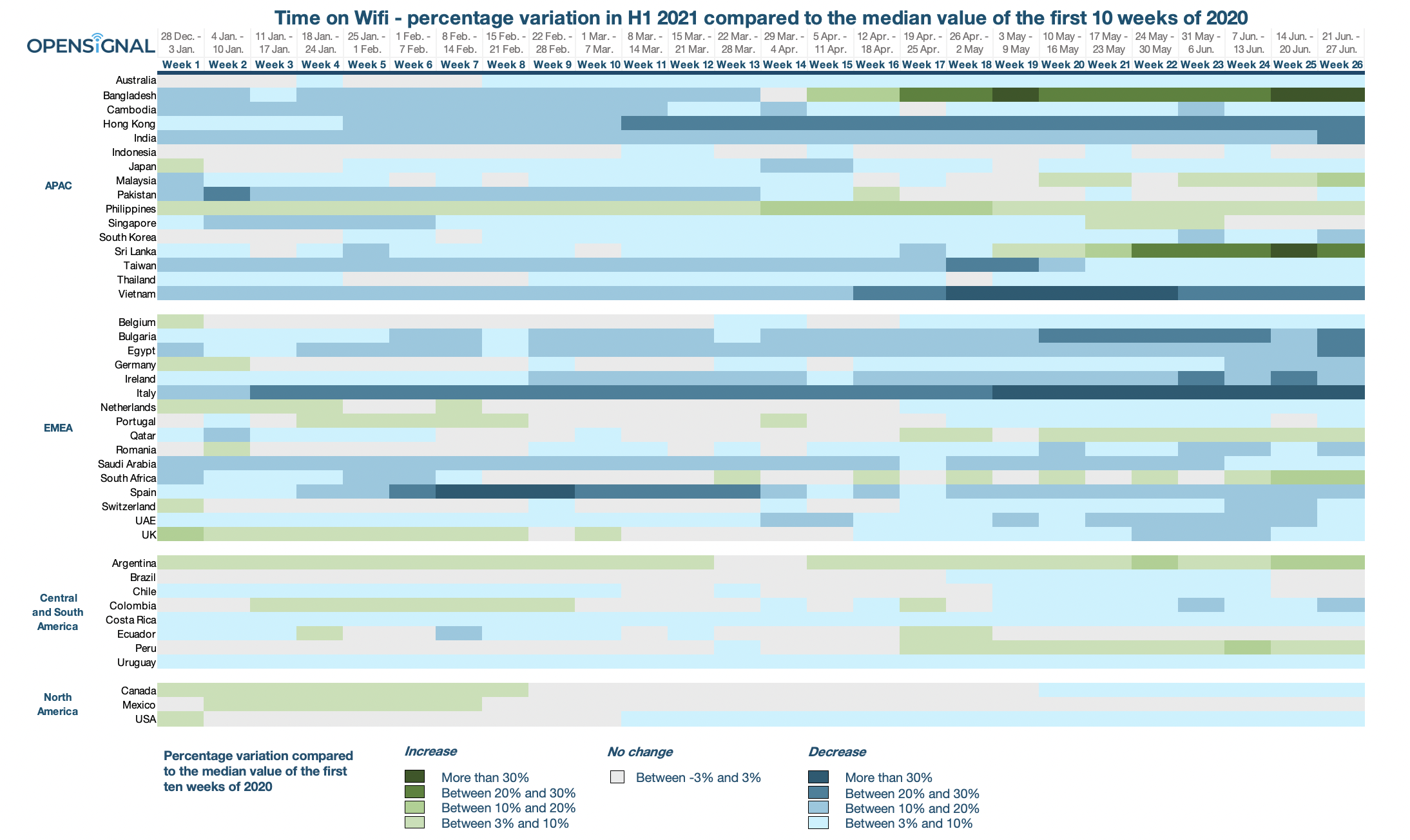

We have also looked at how much time Opensignal users spent on Wifi between March and June 2021, as compared to the first 10 weeks of 2020, before the initial lockdowns. Both before the pandemic and in the initial phase we have seen strong correlations between increased time spent connected to Wifi among our smartphone users and increased time spent at home. For example, normally we see time on Wifi increase at weekends and during public holidays.

Percentage variation of weekly average amount of time mobile devices spent connected to Wifi in 2021 compared to the median value of the first ten weeks of 2020, i.e. between December 30, 2019 and March 8, 2020.

In one of our previous analyses, we observed big increases in Time on Wifi in the middle of March 2020 at the beginning of the pandemic. While the trend waned over the weeks, as the governments eased some lockdown restrictions, we saw this metric gradually decline. However, it was still higher than in the weeks right before the pandemic.

One year later, we see significant declines in time spent connected to Wifi, compared to the first few weeks of national lockdowns in March and April 2020 in most of analyzed markets which indicates mobile users are returning to a more normal mobile lifestyle despite the pandemic. It is worth highlighting that in some markets, declines in Time on Wifi could be explained by seasonal changes — with more users spending time outdoors during summer, in markets where COVID-19 has become less of a concern. Also, some markets saw an earlier outburst of COVID-19, hence the first ten weeks of 2020 for these markets were already in the pandemic.

There are exceptions in several markets, however - in both Bangladesh and Sri Lanka our users are spending substantially more time on Wifi. This is likely a response to the recent wave of COVID-19 that has unfortunately affected the sub-continent in spring 2021. We also saw more increases in Time on Wifi in Malaysia, South Africa or Peru, compared to the first weeks of 2020.

As Opensignal’s data shows, mobile operators in many markets across the world seem to either have further improved the quality of their mobile networks or at least returned to pre-pandemic download speeds, while mobile users appear to spend less time at home, on their home Wifi networks. However, long-term increases in mobile data traffic have revealed the limited capacity of local infrastructure in some markets. As a result, these markets still struggle to achieve the average download speeds our users experienced before the introduction of lockdown measures.

Additional tables - changes in trends between March 9, 2020 and June 28, 2021

Percentage variation of weekly average download speeds between March 9, 2020 and June 28, 2021 as compared to the median value of the first ten weeks of 2020, i.e. between December 30, 2019 and March 8, 2020.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].