Our users in the Philippines have seen considerable improvement in their mobile experience in recent years, both nationally and regionally. Much of this improvement has been driven by an increase in 4G Availability — the proportion of time that our users spent connected to 4G. However, operators in the Philippines continue to operate 3G networks, which are less efficient than newer 4G and 5G technologies in their use of wireless spectrum. If they are able to re-use that 3G spectrum, then the capacity of mobile networks and the overall quality of the mobile experience will improve. However, there are still users that rely on 3G. In this new analysis Opensignal analyzes why smartphone users may not be using 4G. We will refer to these as “3G-only smartphone users” in our analysis.

New market entrant DITO is 4G-only, while both existing operators continue to operate 3G services. If Smart and Globe are able to transition more quickly off 3G services they will be better placed to compete against 4G-only DITO.

Our analysis found three main reasons why many smartphone users in the Philippines never connected to 4G networks and continue to rely upon 3G.

Users do not have a 4G subscription: 81.5% of our 3G-only users in the Philippines had a 4G-capable smartphone and spent time in 4G-covered areas (where we saw other smartphone users connecting to 4G networks on the same mobile network provider). This suggests that the main reason why they did not connect to 4G is that they did not have a 4G SIM card and/or a 4G subscription.

Users don't have a 4G-capable device: 14% of our 3G-only smartphone users in the Philippines spent time in 4G-covered areas but did not have a 4G-capable smartphone. However, it’s important to remember that 4G-capable feature phones are still relatively rare and most feature phones are only capable of connecting to 2G and 3G services.

Users are not covered by 4G networks: 4% of our 3G-only smartphone users had 4G-capable devices but spent their time in areas where we have never seen a 4G measurement on their mobile network operator. This suggests that they did not connect to 4G networks because they spent time in areas outside of 4G coverage. In addition, 0.5% of our 3G-only users lacked both 4G coverage and 4G-capable devices, which brings the number of Filipino 3G-only users outside of the 4G footprint to 4.5%. These results indicate that a lack of 4G coverage is not the key issue as far as the lack of 4G adoption by our 3G-only smartphone users is concerned.

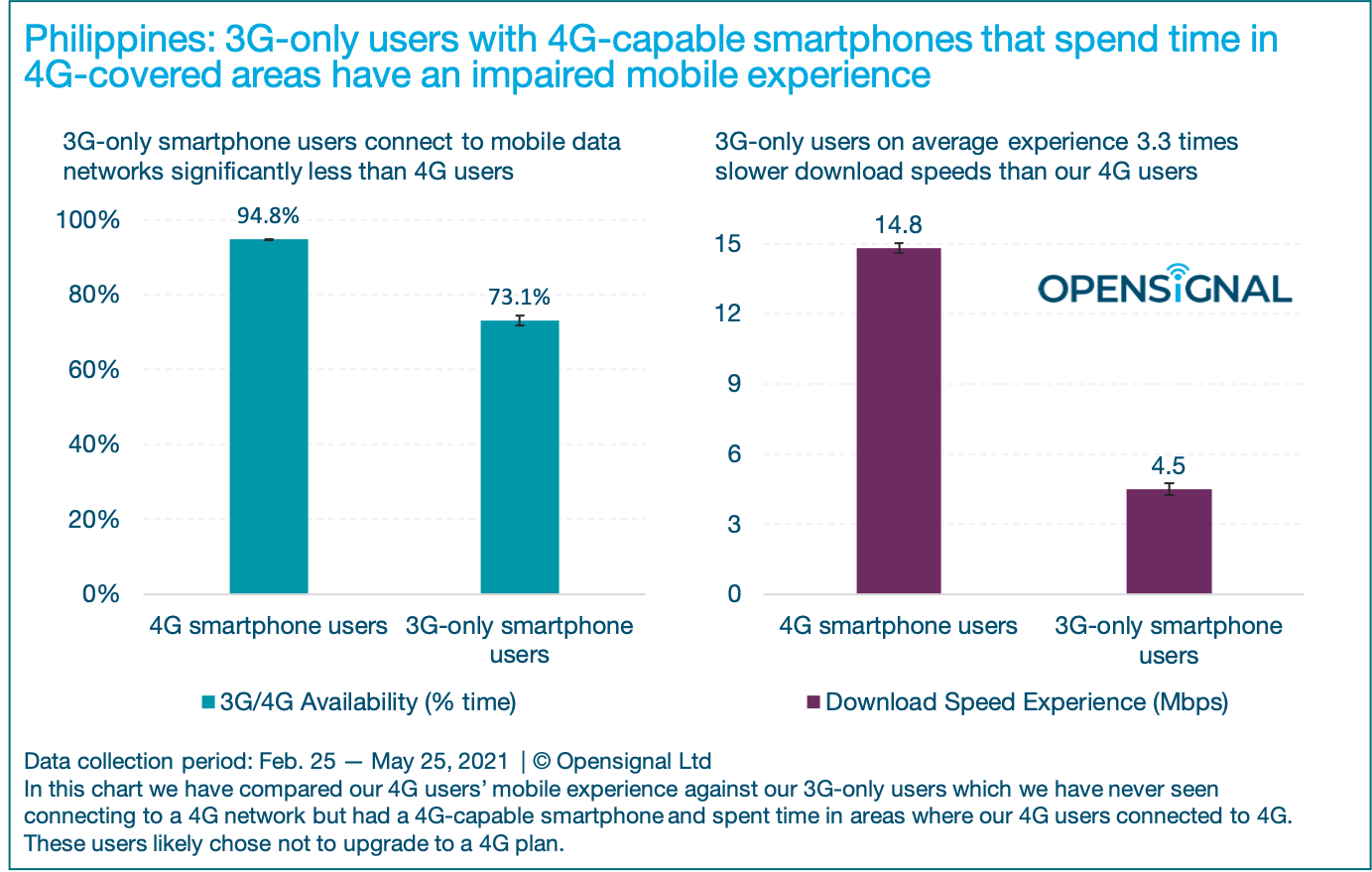

3G-only users have a worse mobile experience compared to 4G users

Not connecting to 4G comes at a cost — our 3G-only smartphone users experienced significantly lower download speeds than their 4G-enabled counterparts. Our 3G-only users reported average download speeds of 4.5 Mbps — 3.3 times slower than those experienced by our 4G users (14.8 Mbps). In addition, 3G-only smartphone users connected to mobile data networks 73.1% of the time — 21.7 percentage points lower than their counterparts with a 4G connection. This suggests that 3G-only users in 4G-covered areas would observe a substantial uplift in their mobile experience if they were to upgrade to 4G.

Currently, the Philippines’ two well-established mobile operators support four generations of mobile technology — 2G, 3G, 4G and 5G while the new player DITO is 4G-only. While Smart and Globe benefit from larger economies of scale than DITO, new operator DITO is able to build a simpler network, though it has recently signed a deal with Nokia to deploy 5G services in Mindanao. Should DITO catch up with its rivals in terms of coverage then Globe and Smart will start to feel the pressure unless they can shut down their legacy 2G and/or 3G networks and refarm the spectrum for 4G/5G use.

Globe has already taken steps in this direction — in October 2020 it announced that it had completed the removal of consumer 3G SIMs across its retail and distribution chains as part of its goal to move its customers over to 4G/5G-ready SIMs to improve their mobile experience. Meanwhile, Anabelle Lim-Chua, PLDT’s chief financial & risk management officer, said in its 4Q 2020 earnings call that 74% of its base uses 4G and that dependency on 2G and 3G is diminishing. These data points highlight the ongoing role of feature phones in the market because the vast majority of feature phones in use are only capable of connecting to 2G or 3G networks. While Globe was still selling 3G SIMs until very recently, a significant minority of Smart users are not yet using 4G.

Among smartphone users the lack of a 4G SIM and tariff is the most significant reason for a smartphone user to be 3G-only. This means that there is still plenty of low-hanging fruit for operators to convert their smartphone user base from legacy 3G to newer 4G and 5G technologies by introducing compelling 4G (or 5G) subscription plans and increasing user education on the benefits of 4G and 5G. By shifting smartphone users off 3G operators would further boost the average mobile experience seen by Filipino users and improve the Philippines’ international standing.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].