Opensignal analyzed our mobile users in Malaysia and found that users who changed their mobile operator on average had a worse mobile experience before they switched compared to the typical experience on their original network.

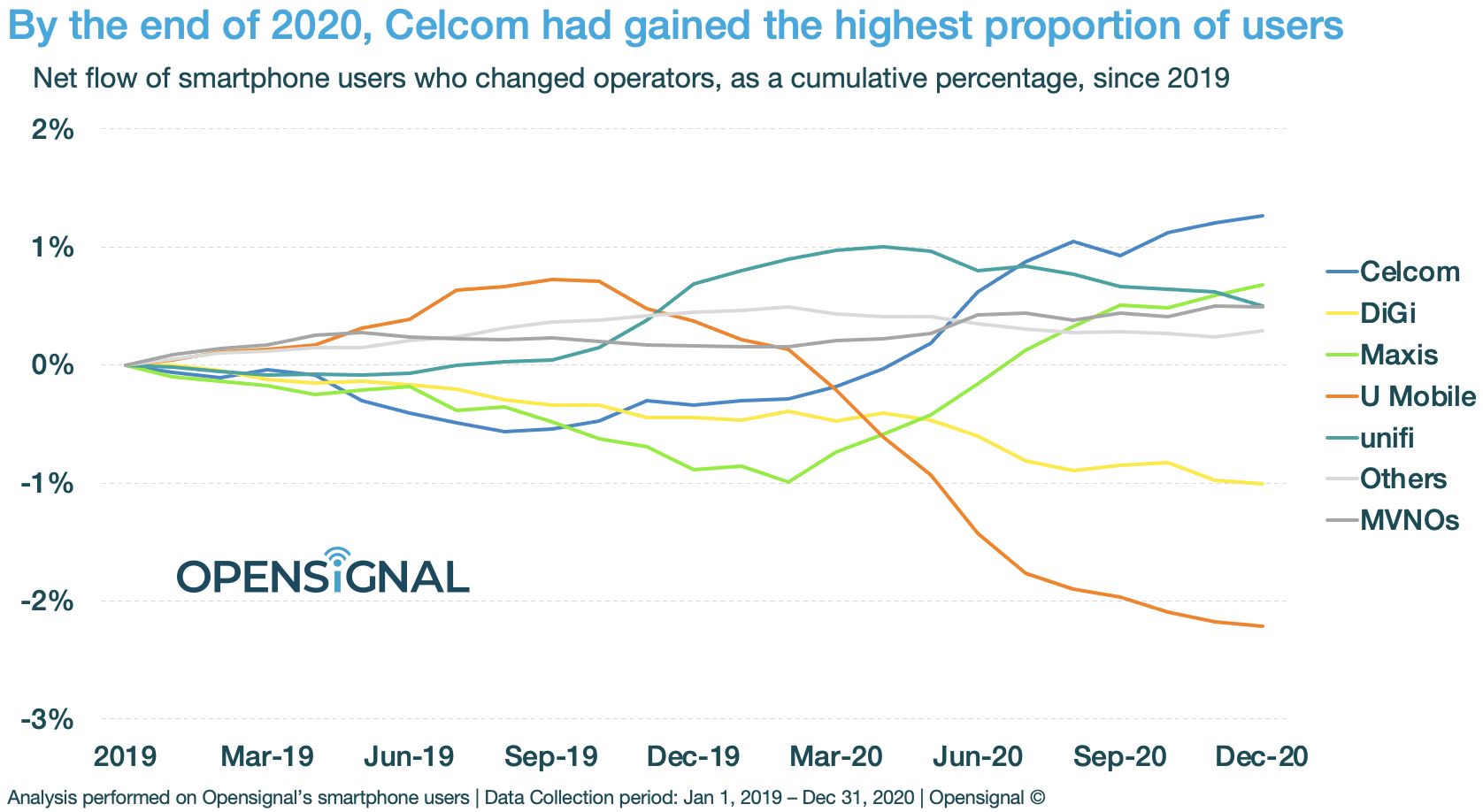

Our data also shows that churn gained momentum after the Movement Control Order (MCO) was implemented in the country and that Celcom and Maxis have been the biggest gainers, followed by Unifi. By contrast, our data shows that DiGi and U Mobile have lost a significant number of users. Mobile virtual network operators (MVNOs) and others (regional operators) have also seen net subscriber gains due to churn.

Malaysia has a highly competitive wireless internet landscape composed of five national operators and a number of other operators — including MVNOs and regional operators — offering various plans and benefits that provide Malaysian users with a variety of connectivity options.

Although it’s common for users to switch mobile operators in Malaysia (and most of South-East Asia), our data shows that churn levels increased during the lockdown when all operators started offering free and/or cheaper data packages. Our data also suggests that with low-cost data offerings being common across the board, the quality of experience is becoming the differentiating factor and is gaining importance as a driver for churn in the Malaysian mobile market.

Opensignal analyzed our smartphone users in Malaysia who changed their mobile network service provider (‘Leavers’) over two years.

Our data shows that for most of 2019, the three largest operators — Celcom, Maxis and DiGi — had been losing smartphone users. In contrast, smaller players like unifi, U Mobile, and other regional operators were gaining users. By the end of 2019, of the big three, Maxis and DiGi had lost a relatively higher proportion of users while Celcom’s net flow of Leavers started to somewhat stabilize after improving in the second part of the year. Meanwhile, U Mobile started losing users towards the end of the year, and unifi continued to add users. We continued to see this pattern until the beginning of 2020.

After the MCO was implemented, Malaysian users became very dependent on mobile networks for their day-to-day activities. Operators started offering 1GB of free data daily for high-speed internet and cheaper plans to extend support to their customers. Simultaneously, Celcom and Maxis started gaining users steadily while U Mobile and DiGi continued losing users. This trend became more pronounced when operators decided to offer a new daily plan for productivity usage.

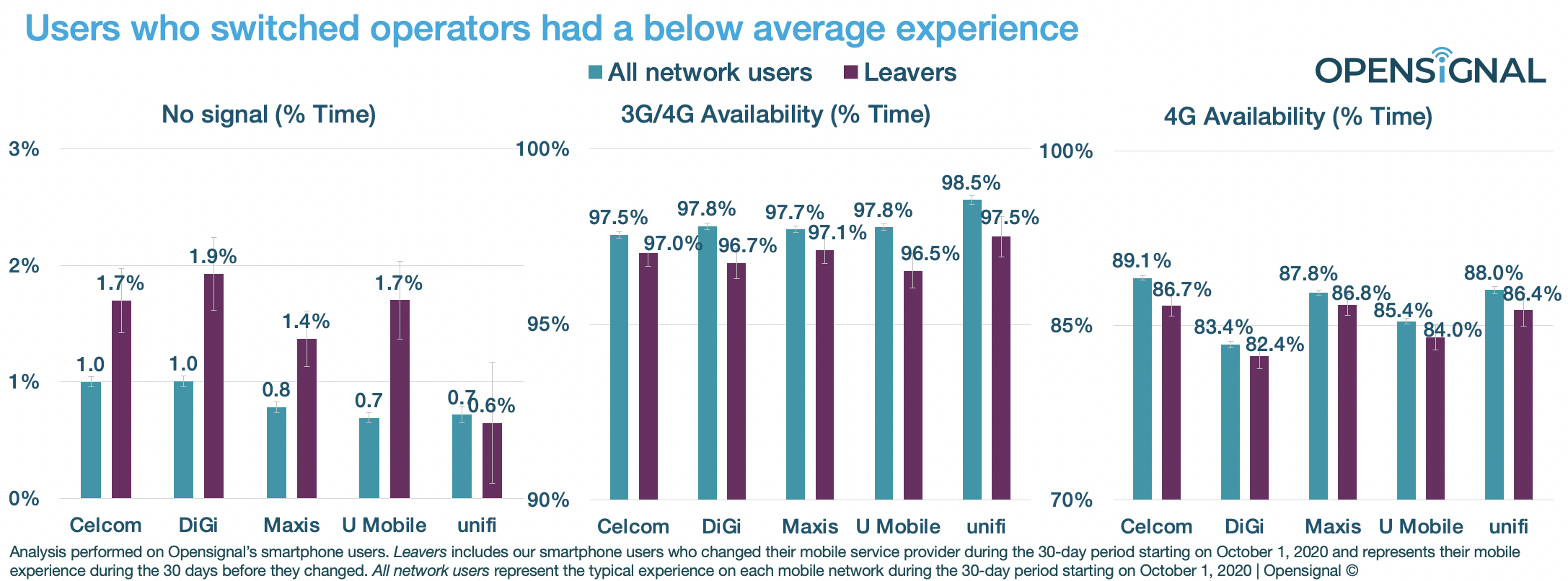

Opensignal also analyzed the mobile experience of Leavers during the last quarter of 2020. We looked at our users’ mobile experience during the 30 days before they changed their mobile operator and compared that against the average experience for users on their original mobile network.

We found that Leavers, on average, had a worse mobile experience before they switched than the typical experience observed by our users on their original network provider. Leavers across all national mobile network operators (MNOs), except unifi, on average spent between 69.8% and 145.5% more time without a mobile signal compared to the average scores on their networks. Leavers on most MNOs also spent less time connected to either a 3G or 4G mobile connection — 3G/4G Availability — and experienced lower 4G Availability. Our data, therefore, suggests that users experiencing mobile network pain points are more likely to change their mobile service provider.

Operators should address users with weak mobile network experience to reduce churn

As Malaysia remains under the MCO and users continue to depend heavily on mobile networks, the quality of experience will continue to play a vital role when users think about changing their mobile network operator. Opensignal’s analysis of Malaysia’s smartphone users shows that in the new normal where price differentiation is ceasing to exist, mobile network experience is extremely important when trying to understand churn.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].