To support 5G development in Brazil, ANATEL (the Brazilian regulator) announced a 5G spectrum auction that is expected to occur in the first half of 2021 and will allow operators to bid for spectrum in the 700 MHz, 2.3 GHz, 3.5 GHz, and 26 GHz bands. But while Brazil is eagerly awaiting the largest spectrum auction in its history and operators are making announcements related to their network strategies, a significant proportion of the population is still dependent on legacy networks. And this will make it harder for Brazilian operators to switch off legacy 3G networks, re-use that existing wireless spectrum to deploy more efficient newer technologies such as 5G or 4G, and improve users’ mobile experience.

Opensignal investigated why some of our users — which we call “3G-only users” — have never connected to a 4G network.

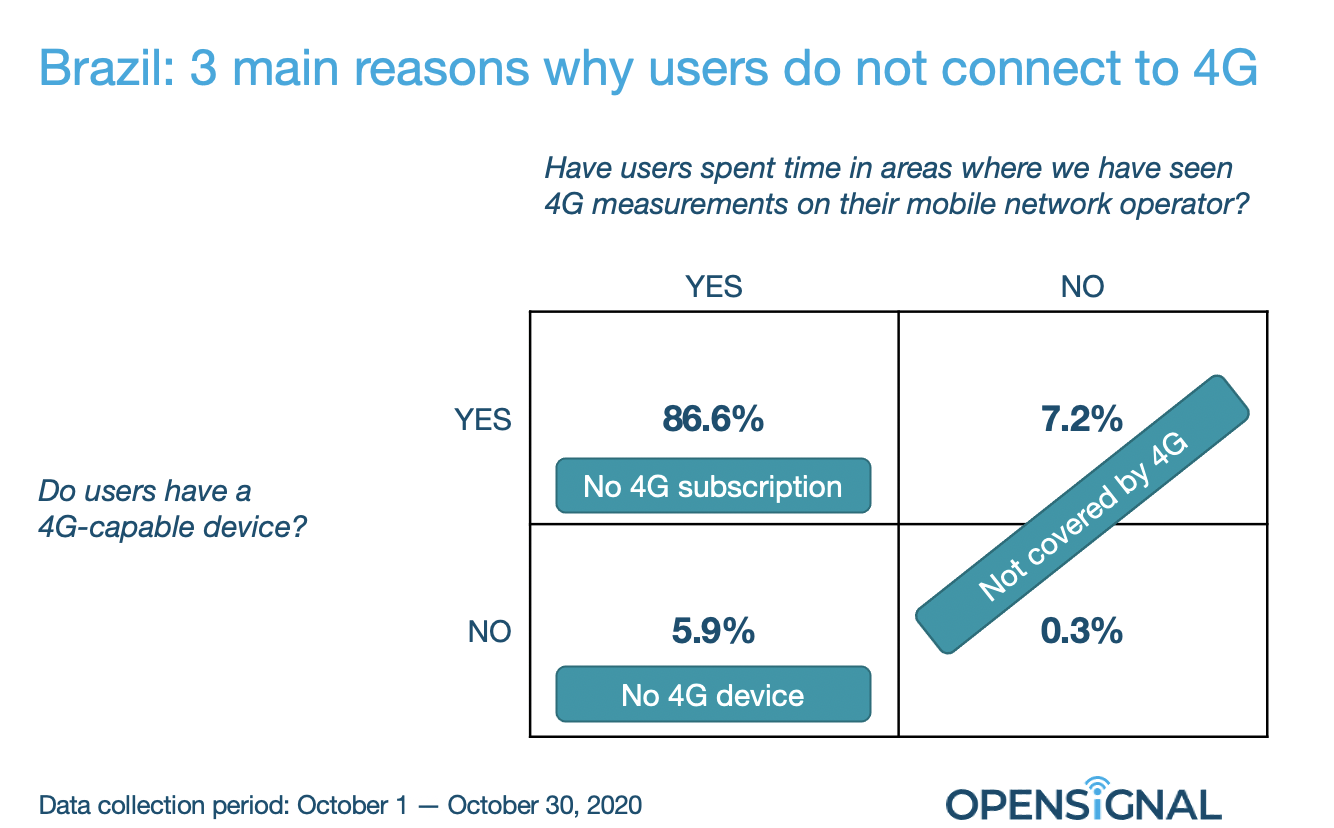

Our analysis found three primary reasons why many Brazilian smartphone users never connected to 4G networks and depended upon 3G networks.

1. Users do not have a 4G subscription: We discovered that 86.6% of our 3G-only users had a 4G-capable device and spent time in 4G-covered areas (where we saw other users connecting to 4G networks on the same mobile network provider). These 3G-only users likely did not upgrade to a 4G subscription or may have disabled 4G connections on their phones. This indicates that if Brazil’s carriers were to introduce compelling 4G rate plans, they could very likely migrate the vast majority of 3G-only users swiftly to 4G networks and accelerate their 5G deployment strategies.

2. Users don't have a 4G-capable device: 5.9% of our 3G-only users in Brazil spent time in 4G-covered areas but did not have a 4G-capable smartphone.

3. Users are not covered by 4G networks: 7.2% of our 3G-only users had 4G-capable devices but spent their time in areas where we have never seen a 4G measurement from them on their mobile network operator, which suggests that they did not connect to 4G networks because they lived in areas where their carrier doesn't offer 4G yet. This small percentage shows that a lack of 4G networks' availability is not the main reason for the large numbers of 3G-only users in Brazil.

3G-only users that aren’t upgrading to 4G have an inferior mobile experience

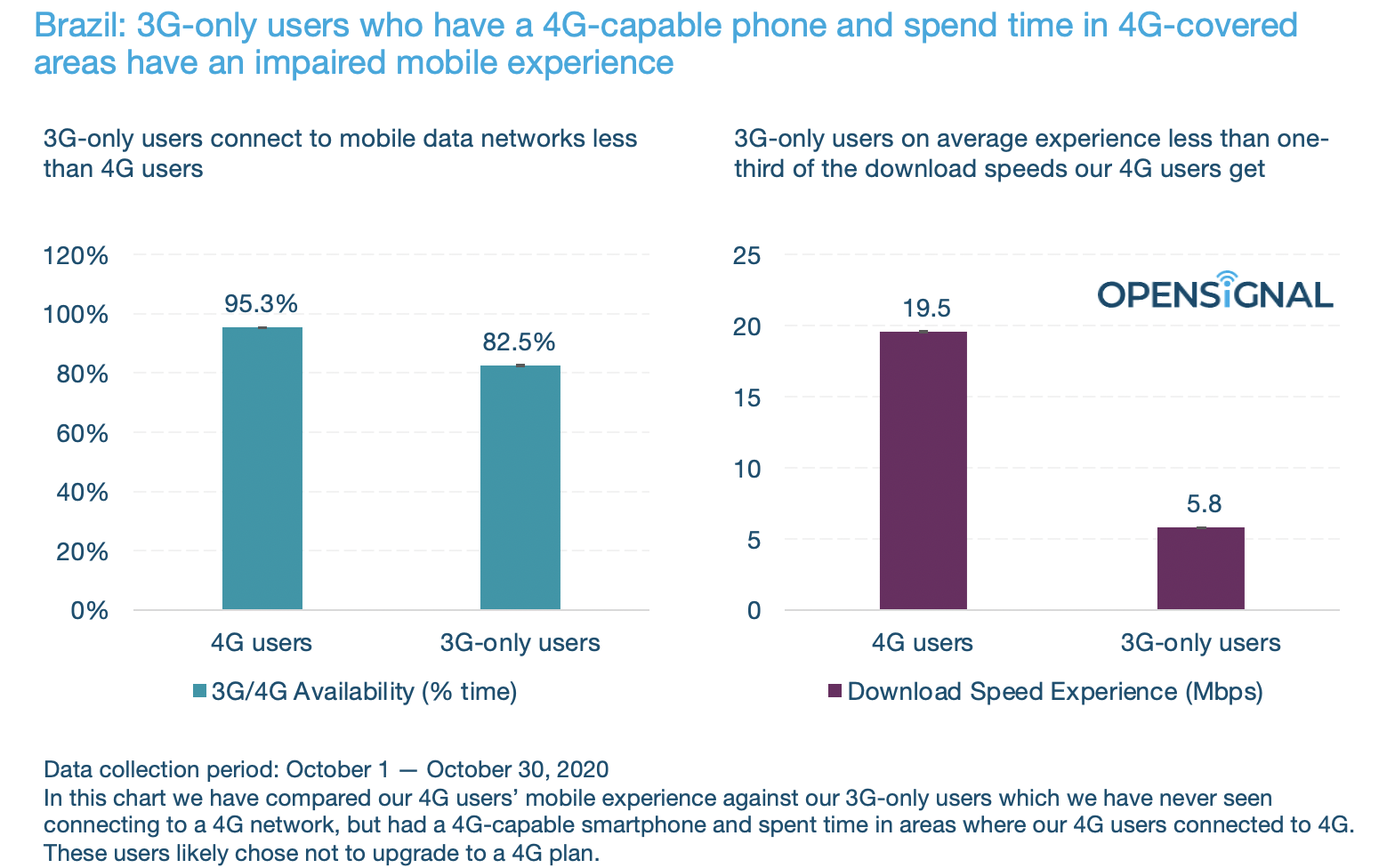

Opensignal analysis revealed that Brazil’s 3G-only smartphone users experienced significantly lower download speeds averaging 5.8 Mbps — less than one-third of that experienced by our 4G users (19.5 Mbps). Furthermore, these users connected to mobile data networks 82.5% of the time — 12.8 percentage points lower than their counterparts with a 4G connection.

Brazil’s mobile operators depend on the 2100 MHz band to a large extent to provide legacy 3G services. This band offers worse signal propagation and penetration than sub-1 GHz frequency bands, such as 850 MHz, the secondary band allocated to 3G by all national operators, except Oi. However, unlike higher spectrum bands, they cannot carry high data loads because there are fewer MHz available at lower frequencies.

We can see also how the properties of the spectrum bands affect our users’ experience. Our 4G users spent significantly greater time — more than 95% of the time — connected to either 4G or 3G than their peers who did not subscribe to 4G. This is because operators have been deploying and upgrading their 4G networks over the last few years and making use of wider signal propagation and greater penetration properties of the 700 MHz band. While TIM and Claro have deployed the 700 MHz band as part of a tri-band carrier aggregation (3C) configuration, alongside 1800 MHz and 2600 MHz frequencies, Vivo also refarmed its 1800 MHz 2G spectrum to achieve the same, boosting both coverage and capacity of their 4G networks.

By migrating 3G-only users to 4G, Brazilian operators can expedite 4G and 5G improvements

Currently, Brazil’s mobile market awaits consolidation as three national operators have jointly bid to acquire Oi’s mobile operations. Through this acquisition, which awaits regulatory approvals, TIM, Claro and Vivo will not just gain Oi’s spectrum or infrastructure or both, but also its mobile user base, of which 3G-only users remain a party.

That said, our data shows a huge disparity that exists in the mobile network experience of our 3G-only and 4G users in Brazil, which may accentuate with the launch of 5G services. As the country is advancing towards 5G, Brazilian operators will benefit from migrating 3G-only users to 4G and re-using existing 3G spectrum bands to add that capacity to 4G networks. That will help accelerate the deployment of 4G and 5G networks and improve the users’ overall mobile network experience.

In the future, as operators will make use of the newly acquired spectrum, it will be interesting to see how the competition shapes up and what effect it has on the Brazilian mobile network experience landscape.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].