Over the past year, Brazil's operators have begun rolling out 4G networks in the 700 MHz band in earnest. But what's been the impact of this bandwidth bonanza on the mobile network experience in Brazil? Following our initial analysis earlier this year on the effect of the rollout on 4G Availability in Rio de Janeiro, it's now time to take a wider look at Brazil's biggest cities, where the rollout of 4G on the 700 MHz band has been focused.

Mobile licenses in the 700 MHz bands are highly sought after, since the relatively low frequency is ideal for network propagation over a wide area, and lower frequency bands like 700 MHz also offer good in-building penetration. Unlike higher bands the spectrum isn't able to carry such high data loads because there are less MHz available at lower frequencies, leading to the risk of congestion in more mature markets if operators rely too much on lower bands — but it's ideal for improving 4G access in such a vast and rapidly-developing market like Brazil.

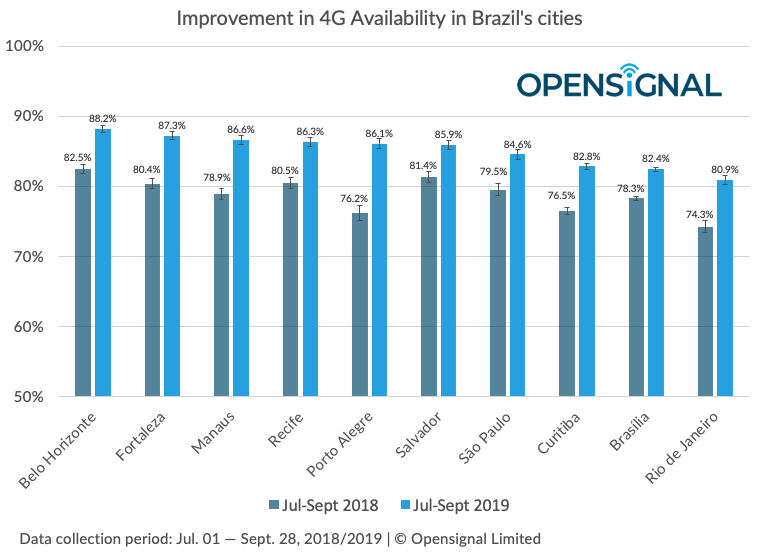

In the past year, we've seen considerable growth in 4G Availability in all of Brazil's 10 largest cities. Comparing data from the 90 days starting 01 July, 2019 with the same period from 2018, we can see time spent connected to 4G — 4G Availability — rose by at least 4 percentage points for our users in all 10 cities. Porto Alegre users saw the greatest improvement of nearly 10 percentage points, followed by those in Manaus who saw growth of well over 7 points.

This data further supports the findings of our most recent report on the Brazilian mobile market, where we saw the leading three operators — Claro, TIM and Vivo — often scoring over 80% 4G Availability in Brazilian cities on a regular basis, while TIM was able to achieve scores of 90% or more in 10 metros. Brazil's fourth national player Oi remains notably behind its rivals in the 4G Availability experienced by our users — and it's likely this rift will grow wider in the near future, since the operator missed out on gaining any 700 MHz spectrum in the last auction.

These improvements in 4G access have had a similar effect on average download speeds seen in Brazil's biggest cities. Our users in all but one of the 10 cities we analyzed saw their Download Speed Experience improve by 3% or more, with Manaus seeing the biggest leap of nearly 50%, or close to 5 Mbps. Interestingly, Porto Alegre, where we saw the greatest increase in 4G Availability, was the only city to see no growth in Download Speed Experience. With users spending more time on 4G, we would normally expect download speeds to increase because of the superiority of 4G technology, but in this instance a spike in data usage could be causing congestion, slowing the networks down.

In order to gauge the extent to which the 700 MHz band is being used in Brazil's cities, we've examined the percentage of our 4G Download Speed measurements that were recorded on the band. We can see the use of the spectrum is already widespread, as at least 16% of our speed measurements were from users connected to 700 MHz networks across all 10 of the largest cities, with the highest proportion being 27% in the capital Brasília.

The percentage of users connecting to 4G via the 700 MHz band will likely continue to grow, but not by much, as most devices will likely try to connect to the higher, preexisting 4G bands when they are available. Similarly, download speeds on the band will begin to plateau and may even fall slightly as more and more users access 4G via 700 MHz and data traffic on the band increases. But the infusion of 700 MHz spectrum will improve 4G Availability, helping Brazil's operators move more users from 3G to 4G.

The rollout of 700 MHz networks is having a marked effect as our users are spending more time on 4G networks and on average enjoying faster download speeds. These network improvements are likely to have a knock-on effect on our other experiential metrics such as Video and Voice App Experience, as related metrics like upload and latency advance and the overall mobile network experience improves. And with a further auction of 5G licenses planned for early next year — including more spectrum in the 700 MHz band — we expect the mobile network experience to continue to improve as the market matures.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].