In this latest definitive analysis of 5G worldwide leaders, there are many new entrants in the top 15 markets across different measures of 5G mobile network experience compared with the last 5G benchmark in March. Bulgaria enters the table in six categories, ranking especially highly on 5G Download Speed (316.8 Mbps), although South Korea tops the table. Puerto Rico is strong on 5G Availability, 5G Reach and Video Experience uplift but misses out from a top 15 market spot elsewhere. And, despite new spectrum scarcity, Singapore has become a global top 15 market for 5G Download Speed.

Malaysia jumps in with high rankings in all three 5G speed categories as well as 5G Games Experience. However, it’s important to understand the different state of 5G roll outs across markets, 5G is still very new in Malaysia with relatively few 5G users. To date, only two operators have signed up to deploy 5G on the controversial single wholesale network. The real-world test for Malaysia will happen in the coming months when multiple Malaysian operators market 5G and we see real mass market uptake.

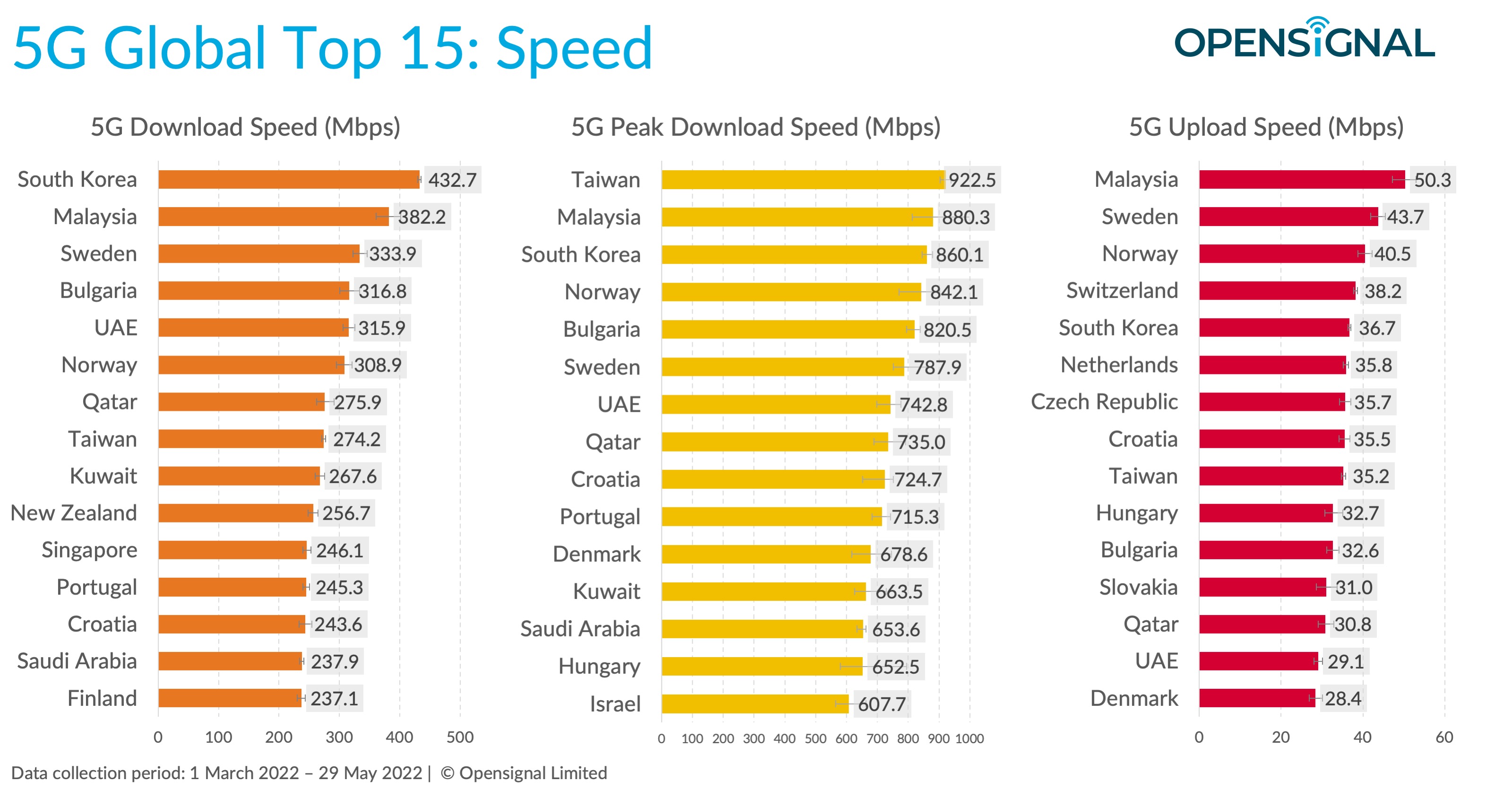

It’s not all change in global 5G leadership. South Korea continues to top the global leaderboard with the highest average 5G Download Speed (432.7 Mbps) again and also holding on to the top 5G Games Experience slot (89.6). Nordic markets continue to do well in multiple categories, as do Gulf Cooperation Council (GCC) markets Kuwait, Qatar, the Kingdom of Saudi Arabia and the UAE. Impressively for such a large geography, the USA continues to rank very highly on both 5G Availability (25.2%) — the time users spend connected to 5G — and on 5G Reach (6.0), which quantifies the proportion of locations where users saw 5G service. Plus, the Philippines continues to see a tremendous uplift with the shift from 4G to 5G, topping the 5G Video Experience uplift category with a 79% increase in its score.

South Korea holds onto the global 5G speed crown ranking top for 5G Download Speed. Where in our last 5G benchmark in March only three markets surpassed the 300 Mbps mark for average 5G download speeds, now there are six. South Korea, Sweden and the UAE have been joined by Bulgaria, Norway and Malaysia — although Malaysia is something of an anomaly because of the limited 5G uptake to date (see above) and the 5G experience there will likely drop dramatically as more users and more operators embrace 5G. Singapore also enters the top 15 for global 5G Download Speed with average speeds of 246.1 Mbps. This is impressive given the spectrum challenges that Singapore has faced.

Local rivalries continue in the 5G Download Speed rankings. New Zealand maintains its top 15 rank but Australia drops off the table. While Saudi Arabia continues to feature, the UAE and Qatar both still rank higher, and all three beat Israel which is no longer among the top 15 worldwide.

On 5G Peak Download Speed, we see much faster speeds than in the 5G Download Speed category where we quantify the average real-world 5G speeds of users. Taiwan tops 5G Peak Download with 922.5 Mbps, but as we have repeatedly seen in previous analyses, South Korea (860.1 Mbps), Norway (842.1 Mbps), Sweden (787.9 Mbps) and the UAE (742.8 Mbps) rank very highly as well. Bulgaria now joins this top 15 table, with a 5G Peak Download Speed of 820.5 Mbps.

The top markets for 5G Upload Speed are mostly unchanged from our previous analyses. Here speeds continue to change little, because in most 5G deployments operators have focused on boosting users’ download speeds rather than upload.

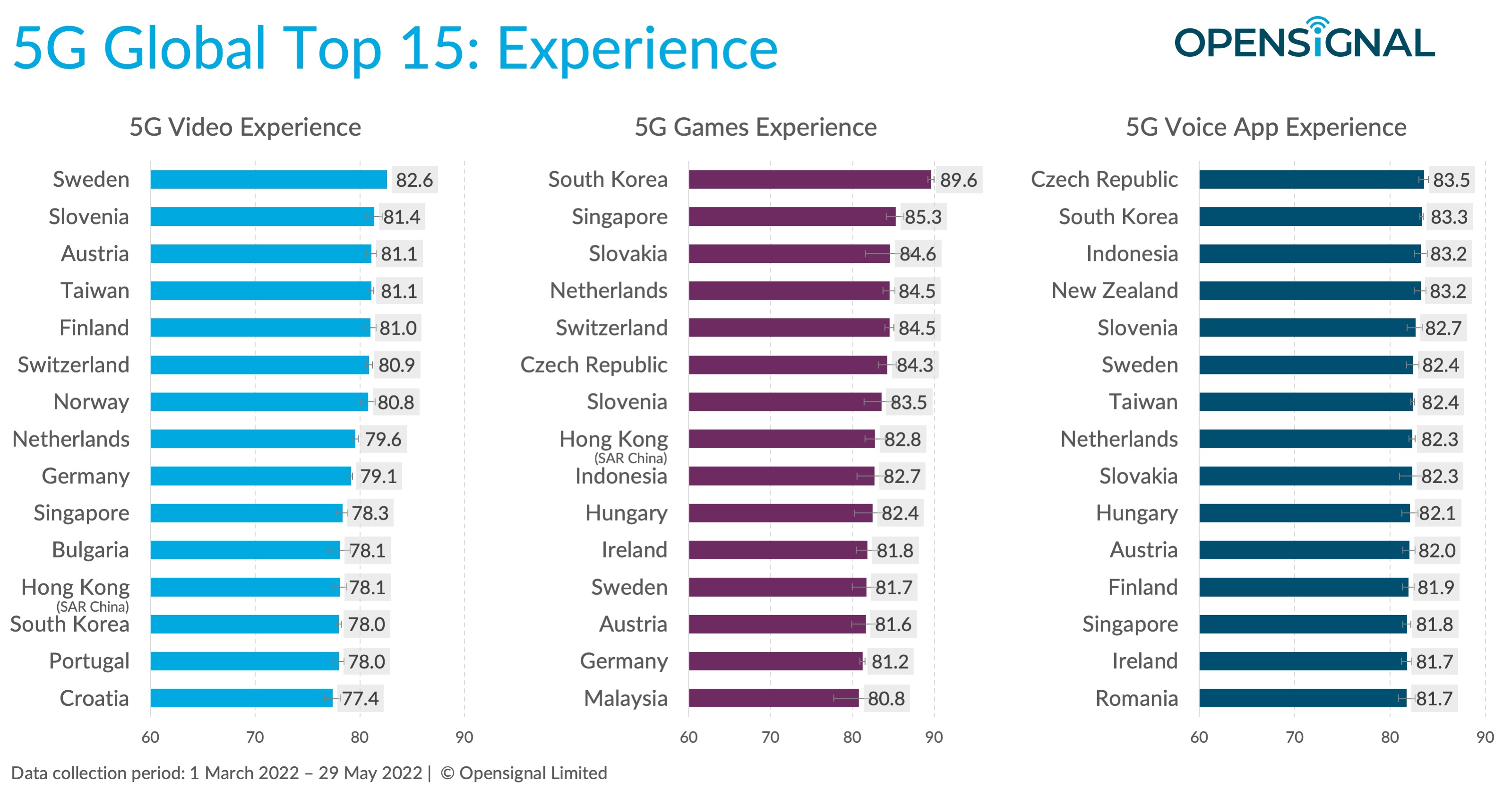

Sweden moves into the top slot for 5G Video Experience, replacing Norway. Croatia moves into the top 15 table while the Czech Republic drops out. European markets feature strongly representing 11 of the positions where in the 5G Download Speed table the continent held just six spots. Outside of Europe, the highest ranked markets for 5G Video Experience are Taiwan (81.1), Singapore (78.3), Hong Kong (78.1) and South Korea (78).

South Korea has a commanding lead in 5G Games Experience with a score of 89.6, over four points ahead of Singapore’s score of 85.3. Setting aside South Korea, across the other fourteen top 15 markets 4.5 points separate the scores, highlighting the extent of South Korea’s dominance here. Notably, this is the only experiential category where Malaysia features in the table highlighting the importance of end-to-end experience for video streaming, multiplayer mobile gaming and voice communications — Malaysia’s 5G wholesale network only covers the access network, essentially the cell towers, and Malaysia’s operators continue to use their existing core networks and peering to enable the complete experience for users.

In 5G Voice App Experience, the Czech Republic and South Korea swap places compared with last time. Singapore and Indonesia jump into the table, Indonesia with a strong 83.2 score that is extremely close to being the highest global score. Under two points on a 100 point scale separate the 15 markets. While Switzerland ranked in the top fifteen for both 5G Video Experience (80.9) and 5G Games Experience, it missed out on a top slot for 5G Voice App Experience.

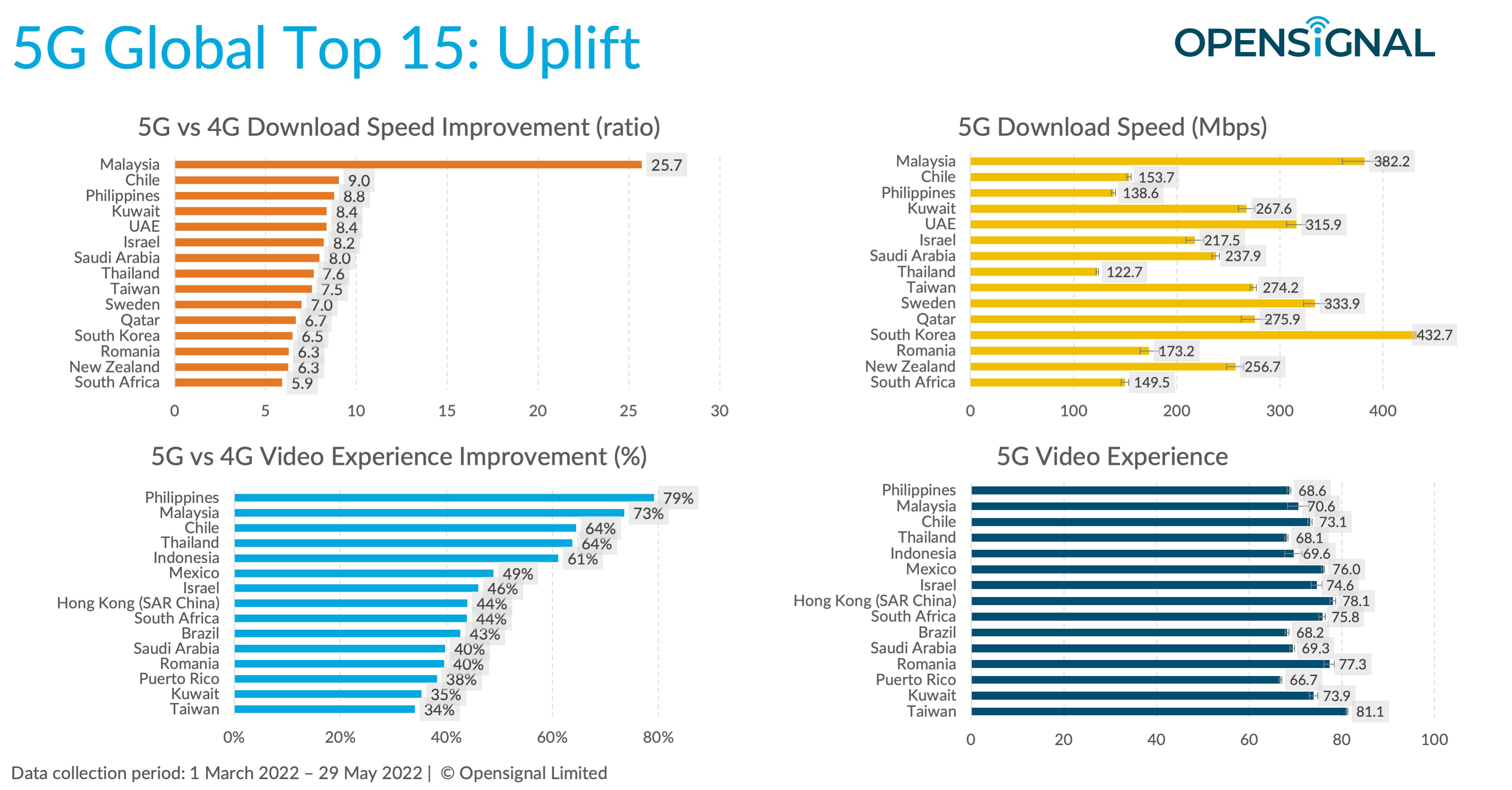

In all 15 markets average 5G download speeds were over five times faster than 4G. Malaysia tops the table for the uplift in users’ average download speeds using 5G over 4G with a staggering 25.7 fold increase. However, there are few 5G users in Malaysia (see above) and this ratio will likely decrease as 5G adoption increases. Excluding Malaysia, Chile continues to top the 5G download speed uplift table followed by the Philippines with the same position as in the last benchmark comparison.

In uplift for Video Experience, the Philippines sees the highest improvement with a 79% increase in mobile video streaming experience with 5G compared with 4G. Chile (64% uplift), Thailand (64%) and Indonesia (61%) complete the top five markets, alongside Malaysia.

With Opensignal’s new video streaming tests including higher resolutions that are more suited to a 5G world we see a greater difference in the video streaming experience using 5G compared with 4G. The uplift with 5G is now considerably higher. Across the top 15 markets for uplift the range is from 79% to 34% in their Video Experience improvement with 5G. By comparison, in the previous insight the highest rated market saw an Video Experience uplift of 33%.

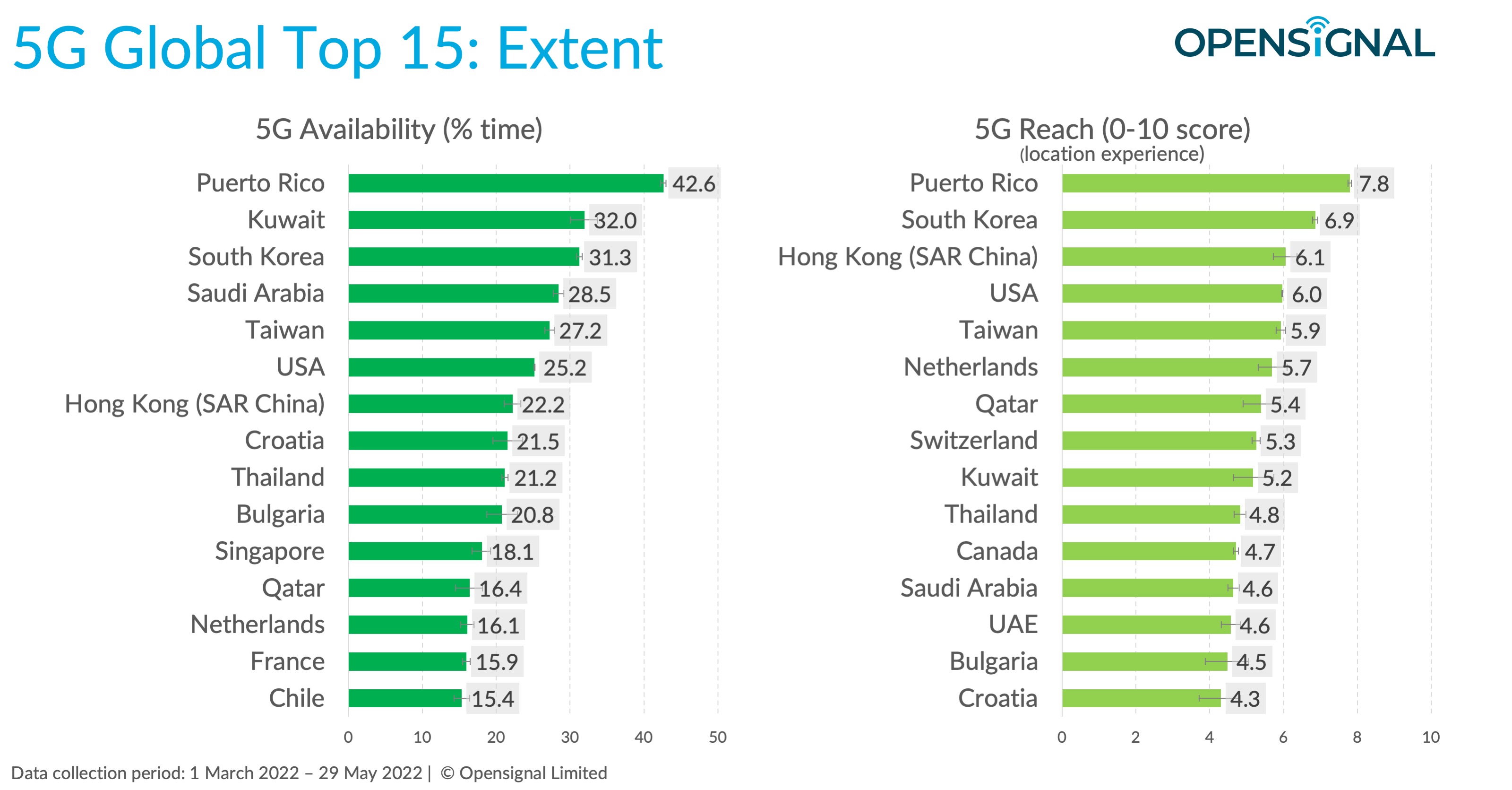

To compare the extent of 5G services it’s important to consider the size of a market and the nature of its geography. Large markets such as the U.S., Saudi Arabia, or France with extensive rural or wilderness areas are harder for operators to serve with 5G than are compact markets such as city states or those with small concentrated populations.

While Puerto Rico tops the 5G Availability and 5G Reach global tables in part because of operators’ use of low band spectrum for 5G services that are suited for wide coverage, the results of the U.S. are considerably more impressive. There, as in Puerto Rico, operators have deployed 5G using low band spectrum but despite the vastly greater size of the U.S. they have achieved a 5G Availability score of 25.2% meaning users spent over one quarter of time with an active 5G connection. Similarly, the proportion of locations where users saw 5G services was six on a 10 point scale — 5G Reach — indicating that in approaching two thirds of locations 5G signals were present.

Canada too does astonishingly well, ranking in the top 15 global markets for 5G Reach with a score of 4.7 despite being even larger than the U.S. Similarly, the Kingdom of Saudi Arabia’s achievement of 28.5% 5G Availability and 4.6 5G Reach are scores that are considerably harder to hit in a market this vast, when compared with the still strong results of neighbors Kuwait and Qatar.

Switzerland ranks among the global leaders for 5G Reach but is not among them for 5G Availability. While the proportion of locations where our users see 5G services — 5G Reach — is high (5.3), the time users spend connected to 5G is not among the top 15 globally likely because of the impact of lower 5G power levels in Switzerland on indoor 5G availability.

5G Advanced is on its way

While users have been embracing the 5G experience in increasingly large numbers and operators have been deploying the initial versions of 5G, the industry has been looking to what’s next. 5G release 16 and 17 are now final and will be deployed over the next couple of years, while work on Release 18 is already advancing fast. As with 4G/LTE, there will be new marketing terms used to describe these upcoming 5G standards.

Again, as we saw with the terms “LTE Advanced” and “LTE Advanced Pro” in the second phase of the 4G era we will likely see vendors and operators market these enhanced versions of 5G using the phrase “5G Advanced”. However, the most important test will continue to be the extent to which these new flavors of 5G improve — or actually advance — the real-world experience of users. Opensignal will continue to analyze 5G using a single independent global methodology that enables straightforward comparisons of 5G’s benefits.

Opensignal Limited retains ownership of this insight including all intellectual property rights, data, content, graphs & analysis. Reports and insights produced by Opensignal Limited may not be quoted, reproduced, distributed, published for any commercial purpose (including use in advertisements or other promotional content) without prior written consent. Journalists are encouraged to quote information included in Opensignal reports and insights provided they include clear source attribution. For more information, contact [email protected].